Yen Weak Despite Hawkish BOJ Chatter

BOJ Market Chatter

Expectations of forthcoming tightening from the Bank of Japan have ratcheted higher this week. Reuters is running an article citing BOJ sources’ suggesting that the bank could go for a larger-than-expected quantitative tightening at the July meeting, along with a surprise rate hike. With JPY having fallen sharply since the last BOJ meeting, many traders have been toying with the idea of some surprise action from the BOJ to help bolster the Yen. Despite this chatter, however, USDJPY has rallied almost 5% from the June lows, creating an even greater need for action. The big issue for the BOJ is that a weaker JPY helps drive up import inflation, ultimately offsetting the impact of BOJ tightening.

Shifting Expectations & JPY Impact

At the last meeting, the BOJ held policy level across the board, despite some expectation that a shift in bond purchases could be announced. Instead, the BOJ outlined that a change in course on bonds was under discussion and would be announced in July. Given that expectations for a double announcement are starting to rise, the key thing for the BOJ will be how it makes an effective enough move. To this end, a rate hike alongside a higher level of QT looks likely. However, we might also hear the BOJ taking a more firmly hawkish tone, paving the way for a quicker pace of tightening than previously expected. If seen, this should help drive some reversal action in USDJPY, particularly if we see Fed easing expectations growing this month.

Technical Views

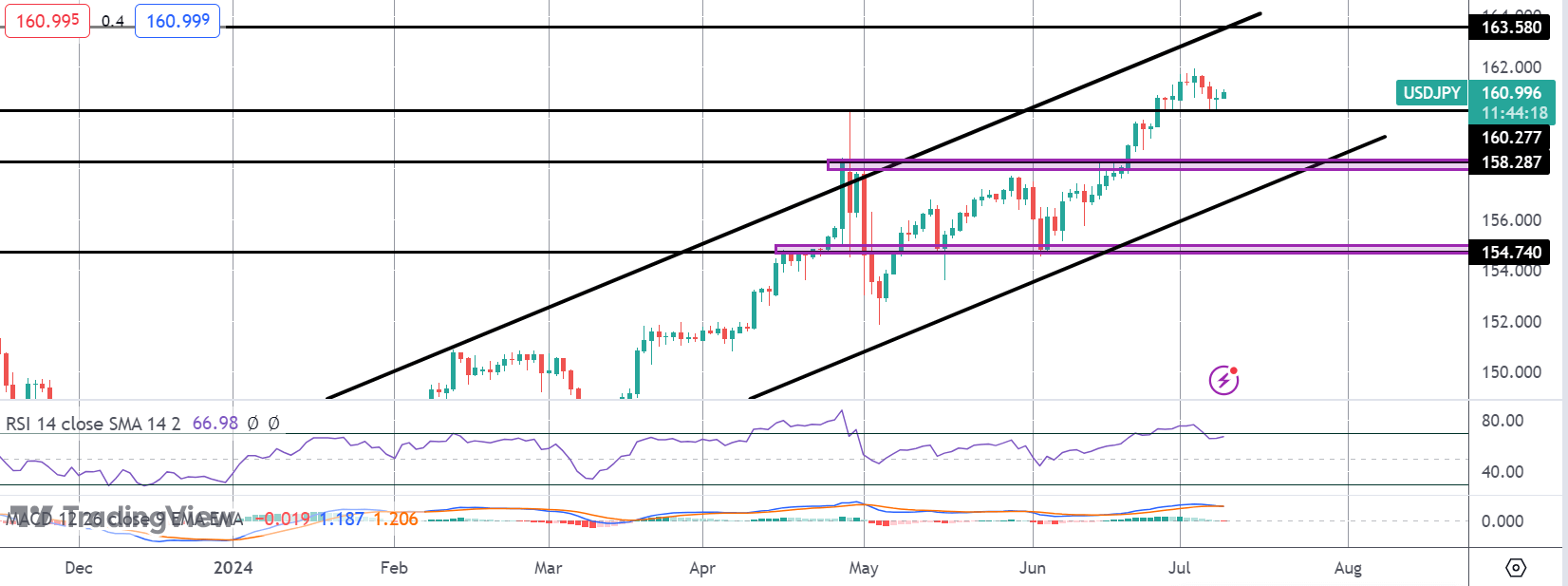

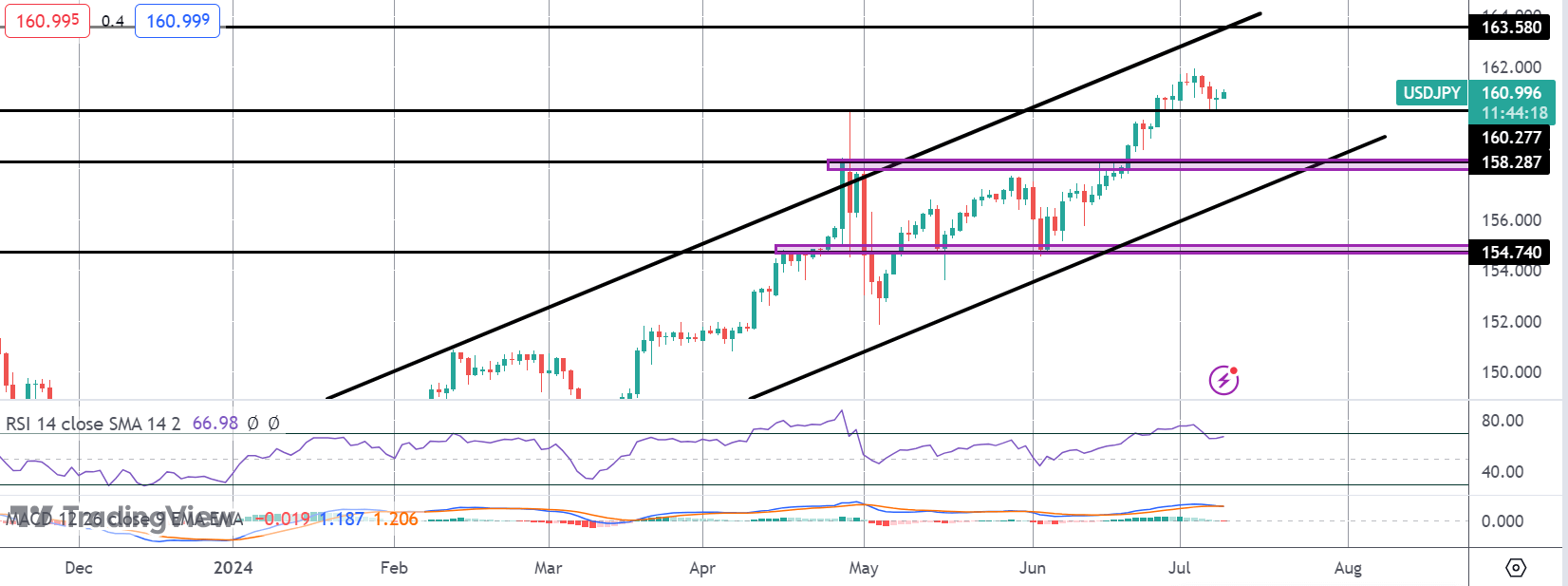

USDJPY

The breakout rally in USDJPY has stalled for now though price remains atop the 160.22 level. For now, the focus is on a continuation higher, given the bull channel framing price action, with 163.58 sitting above as the bull target. To the downside, 158.28 remains key support with the bull channel lows there also.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.