Will BOE/Fed Divergence Drive GBPUSD Higher?

BOE to Hold Following Unchanged CPI

The British Pound is trading higher today on the back of the latest UK economic data released this morning. Annualised CPI for August was seen holding steady at 2.2%, in line with expectations. The data strengthens the view that the BOE will hold rates steady tomorrow at 5%. On the back of a slew of better-than-forecast data recently, it would have likely taken a decent downside surprise in today’s inflation data to push the bank towards further easing. Indeed, looking at the breakdown of the data, services inflation (a closely watched component by the bank) continued to rise last month. Against this backdrop, the BOE is expected to hold steady while it awaits further data.

Fed Impact on GBPUSD

Given that the Fed is widely expected to cut rates today, with some expectation of a deeper .5% cut, GBP stands to gain ground this week against USD. If the Fed does opt for a larger cut and the BOE holds steady tomorrow, this should see GBPUSD breaking out to fresh highs. A smaller cut from the Fed might muddy the near-term outlook however. Given the built up dovish expectation in the market, it's likely we see a short-covering rally in USD on a smaller cut. However, the updated dot plot forecasts and forward guidance from the Fed should be dovish enough to temper USD gains, ultimately creating room for GBPUSD to push higher beyond this week.

Technical Views

GBPUSD

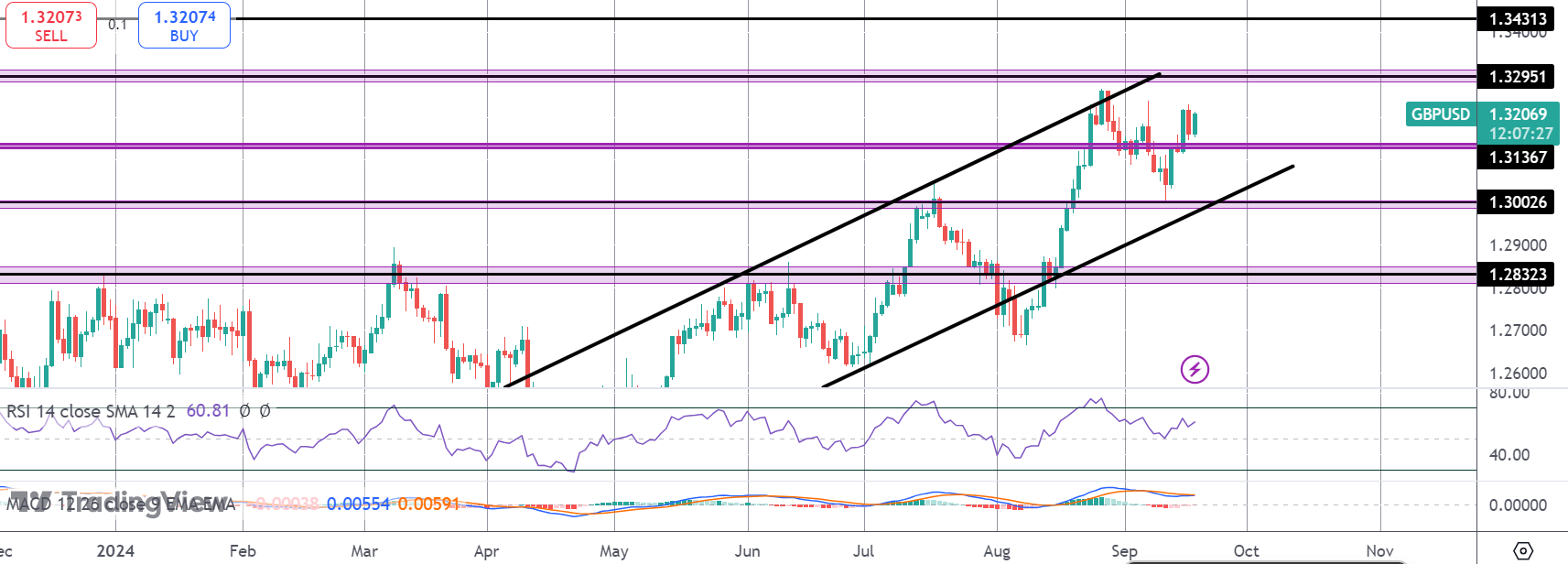

For now, GBPUSD is sitting mid-channel, holding above the 1.3136 level. While this support holds, focus is on a fresh push higher above local resistance at the 1.3295 level, targeting 1.3431 as the next bull objective. To the downside, 1.30 and the bull channel lows remain key support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.