This Broken Link Between Banks and Bond Markets Indicates Central Bank Support is the Only Thing that Matters for Stocks

Price action in European equities and US futures lack clear direction on Tuesday as markets wait for a "Christmas gift" in the form of a fiscal deal. In the absence of news headlines signaling about progress in stimulus talks, there is a chance for equity markets to stage a minor pullback (scenario that we discussed yesterday) and the signs of bearish pressure do persist. The greenback remained weak against other majors, trading below the key foothold at 91 points.

While stocks markets trade near all-time highs, sustained by expectations and liquidity backstop from the Central Banks, signaling that the worst is over, the Bank of International Settlements issued a warning, saying that the crisis is moving from liquidity to default phase.

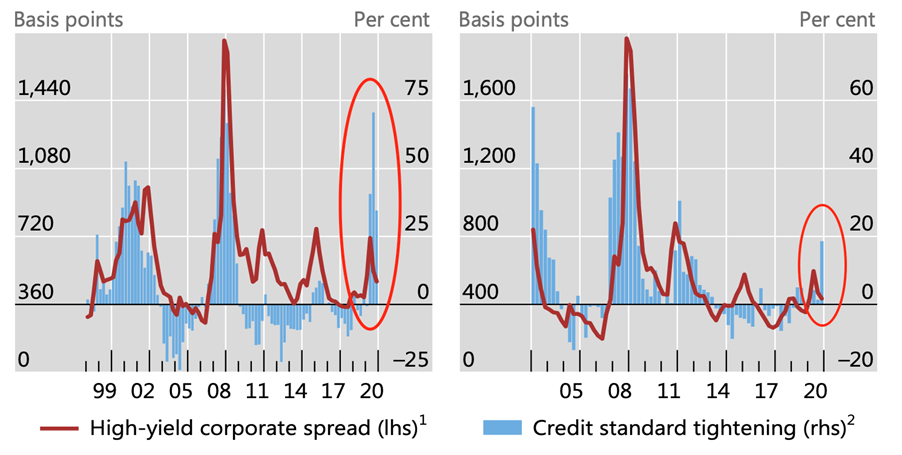

In its quarterly report released on Monday, the "bank of all central banks" said that while the recent rally in global equity markets was justified by compression of interest rates in bond markets and rotation of investors into risky assets, quick development of vaccine and thus foreseeable end of the pandemic, current market valuations may not fully reflect the risks of defaults. This is better reflected in dynamics of credit spreads in the US and Europe which rapid decline remains out of step with stalling recovery of firm revenues, key measure of quality of a firm as a borrower. It means that bond market valuations may underestimate risks of corporate defaults as well.

In this regard, it is significant how the two major groups of lenders - banks and market investors (indirect and direct channel of financing) changed their lending attitude. If the former has been tightening their credit standards, the latter, on the contrary, has been lowering the credit risk bar:

Bank and bond market assessment of credit risk usually move in sync, but now we a strong divergence which suggests there is a strong factor breaking the interplay. This factor is obviously “unlimited” credit facilities offered by Central Banks and it means that complacency in bond markets may hinge heavily on the Central Bank backstop.

Anyway, current focus remains on the stimulus talks in the US. In addition to disagreements between parties, there is another obstacle on the way to a fiscal deal - a Christmas shutdown. The work of Congress is funded until December 11, so in order not to interrupt negotiations, legislators will first have to approve a bill that will finance another week of work and bring fiscal negotiations to their logical conclusion. Therefore, the focus of the markets is primarily on whether Congress will succeed in approving funding bill. The voting on the bill is due on Wednesday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.