The IndeX Files 03-12-2019

Markets Reverse on Trade Deal Uncertainty

Global equities benchmarks suffered a severe shift in sentiment this week with asset markets selling off on rising fears over the health of US-Sino trade talks. Late last week, it was reported that the US administration approved a bill supporting the rights of the Hong Kong protestors. The situation ins Hong Kong has deteriorated dangerously over recent weeks and has become a major source of international pressure. While Trump had so far been able to avoid having to intervene, the building domestic political pressure has now culminated in Trump having to back the bill. China has consistently warned the US not to meddle in domestic affairs and investors are now worried that the bill will act as a roadblock to the signing of the phase one trade deal. Relations have now visibly worsened with China announcing that it has postponed a planned US military visit to China over the US backing of the Hong Kong protestors.

Fears over the course of negotiations have taken centre stage this week, causing ripples throughout Asian, European and UK markets as investors fear that the global slowdown could be set to worsen. US data on Monday showed the manufacturing sector remaining below the neutral level last month at 48.1. This was lower than last month’s 48.3 reading and also below the market forecast of 49.2. On the back of equally weak readings in the UK and Europe, we are seeing a bearish shift in investor appetite at current levels.

Technical & Trade Views

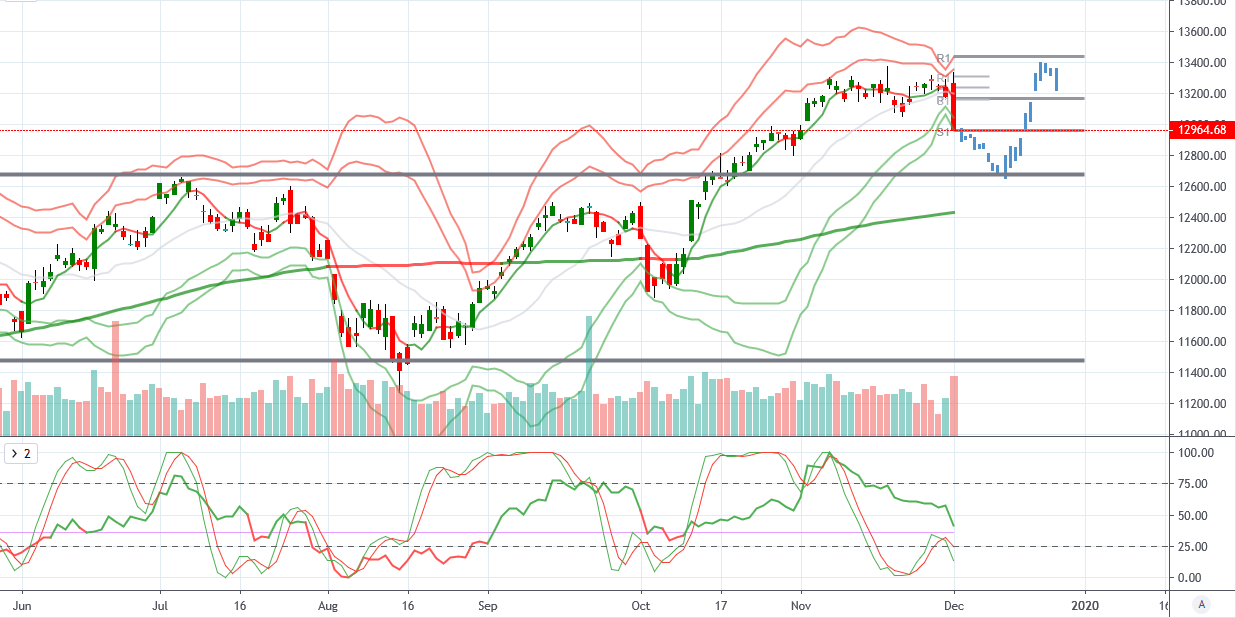

DAX (Bearish below 12677.1)

From a technical and trading perspective. DAX has posted a strong reversal signal here, moving below the monthly pivot at 13155.27, suggesting a move back down to retest the broken highs and yearly R1 at 12677.1. With longer-term VWAP still positive, this region is likely to act as support though I will reassess if we move below.

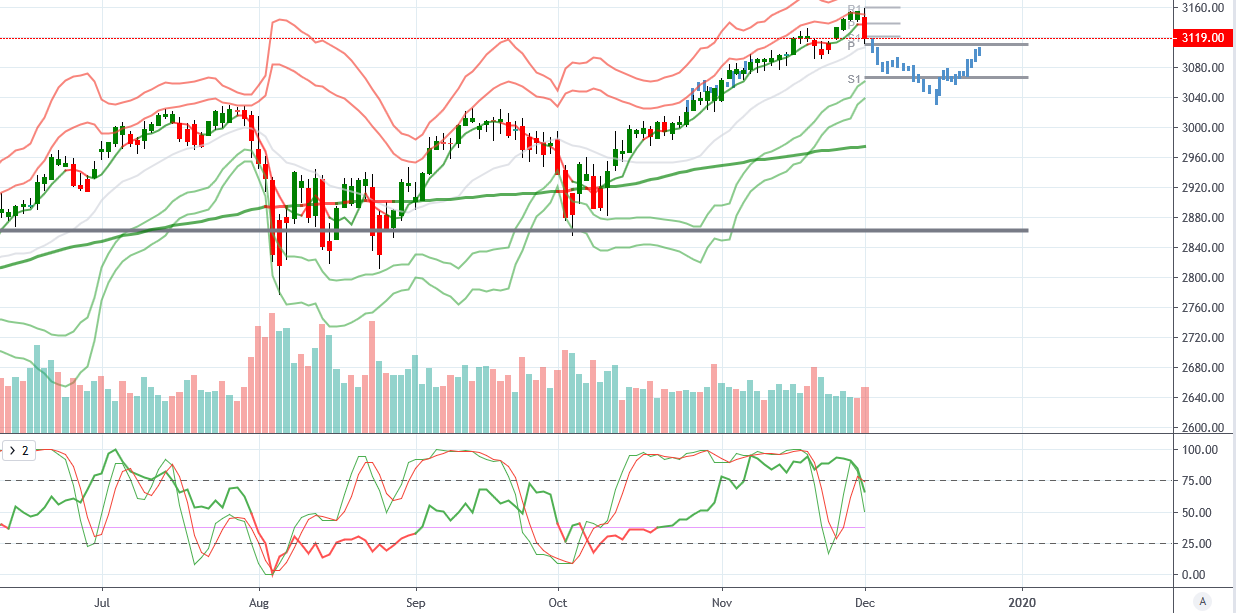

S&P500 (Bearish below 3109.25 )

S&P500 From a technical and trade perspective. Price is posting a strong bearish reversal signal here suggesting a deep correction lower is likely if we move below the monthly pivot at 3109.25. Bulls will be looking for a retest of the broken former highs at 3031 to act as support, keeping the longer-term bias bullish in line with longer-term VWAP.

FTSE (Bearish below 7338.6)

FTSE From a technical and trading perspective. While below the monthly pivot at 7338.6, FTSE is vulnerable to a deeper move lower here towards the yearly pivot at 7060.9 where stronger bids are likely to be seen. While longer-term VWAP is still positive, sideways action is starting to get the best of the market in the short term.

Nikkei (Bearish, below 23242.1)

From a technical and trade perspective. Price action is threatening a move lower here. While longer-term VWAP remains positive, the long term outlook is still bullish, though risk of a pullback are growing. While below the monthly pivot at 23242.1, a deeper push lower is possible.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!