The FTSE Finish Line - July 1 - 2024

The FTSE Finish Line - July 1 - 2024

UK Investors Cautious Ahead Of Political Risk

The week started positively for London stocks, with support from the real estate sector and following gains in the European market as hopes for global interest rate cuts revived. The FTSE 100,had looked set to break a four-session losing streak, while the mid-cap FTSE 250 also saw modest gain, however, risk sentiment stalled and into the close the FTSE is in the red. Additionally, the far-right party won the first-round voting in France's surprise snap election over the weekend.

Property stocks in the London market experienced a 1.2% increase, making them one of the top gainers. This rise followed a Nationwide report indicating a slight increase in British house prices from May to June, despite the lingering impact of higher interest rates on the property market. Real estate investment trusts (REITs) also saw a gain of 1.3%. As the UK approaches its domestic parliamentary elections on Thursday, polls suggest that Labour Party leader Keir Starmer may replace Conservative Rishi Sunak as the next prime minister.

In corporate updates, Anglo American's shares dropped by 3.2% and the company announced the suspension of production at its Australian metallurgical coal mine due to an underground fire that occurred on Saturday.

Petrofac, saw an increase in its stock as noteholders agreed to extend a contract. At 09:23, shares in Petrofac were up 7.7% at 14p, making it the top percentage gainer on the FTSE smallcaps index. The oilfield services firm reached an agreement to extend the existing agreement for non-payment of interest coupon on its senior secured notes with an ad hoc group of note holders, extending the period to July 25. This extension is intended to provide time for the group's financial restructuring, materially strengthen the balance sheet, and improve liquidity. Despite this positive development, the stock is still down approximately 62% so far this year.

The FX market's volatility, which is essential for options trading, is unpredictable but crucial for determining premium prices. Implied volatility serves as a proxy for actual volatility and reflects market sentiment. The 1-week GBPUSD implied volatility has increased to 6.7 from 5.7, reaching 6.2 since the UK election was announced. In comparison, the 1-month expiry implied volatility is at 6.1, down from 7.0 in mid-June, with 5.5 being the long-term low. Despite this, risk reversals still indicate a stronger preference for GBP put options over call options, suggesting that the market anticipates a higher likelihood of GBP depreciation rather than appreciation. The recent appreciation of EURGBP rates is primarily driven by concerns over the French election's impact on the euro.

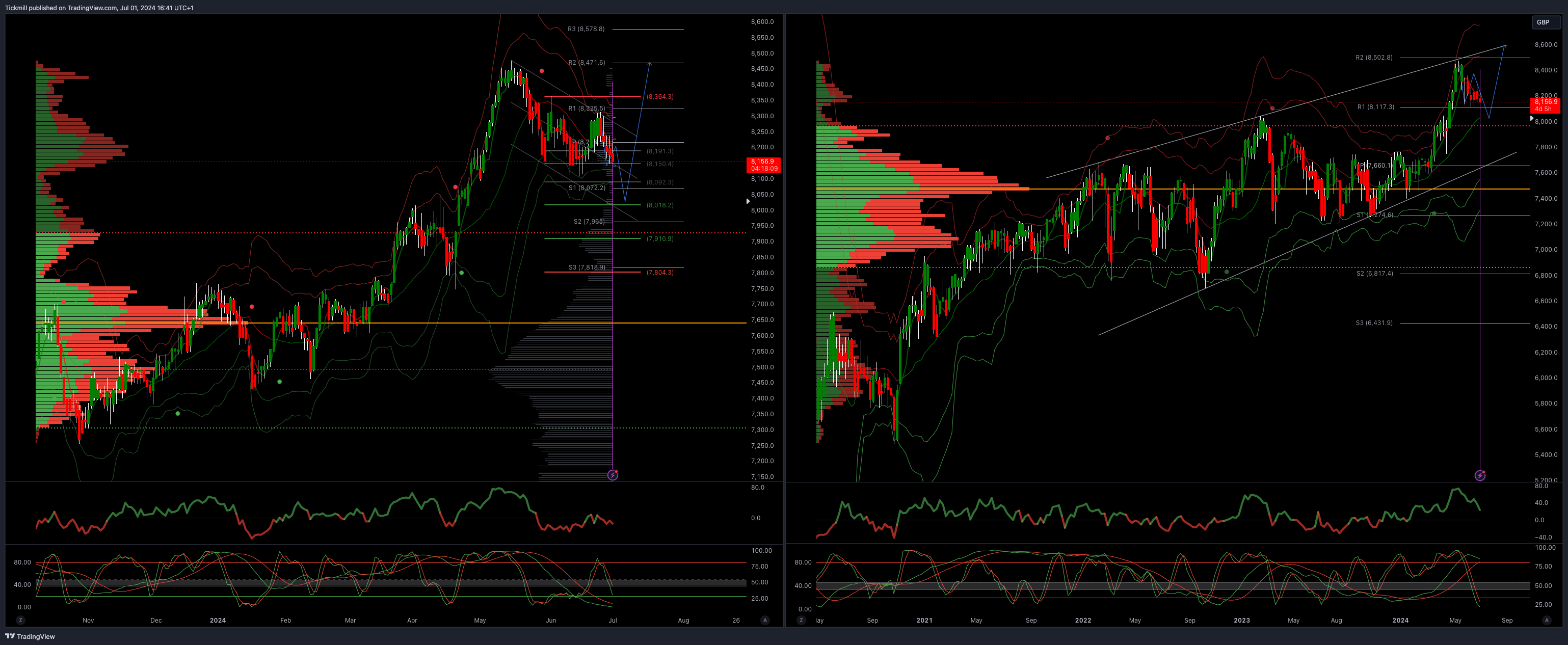

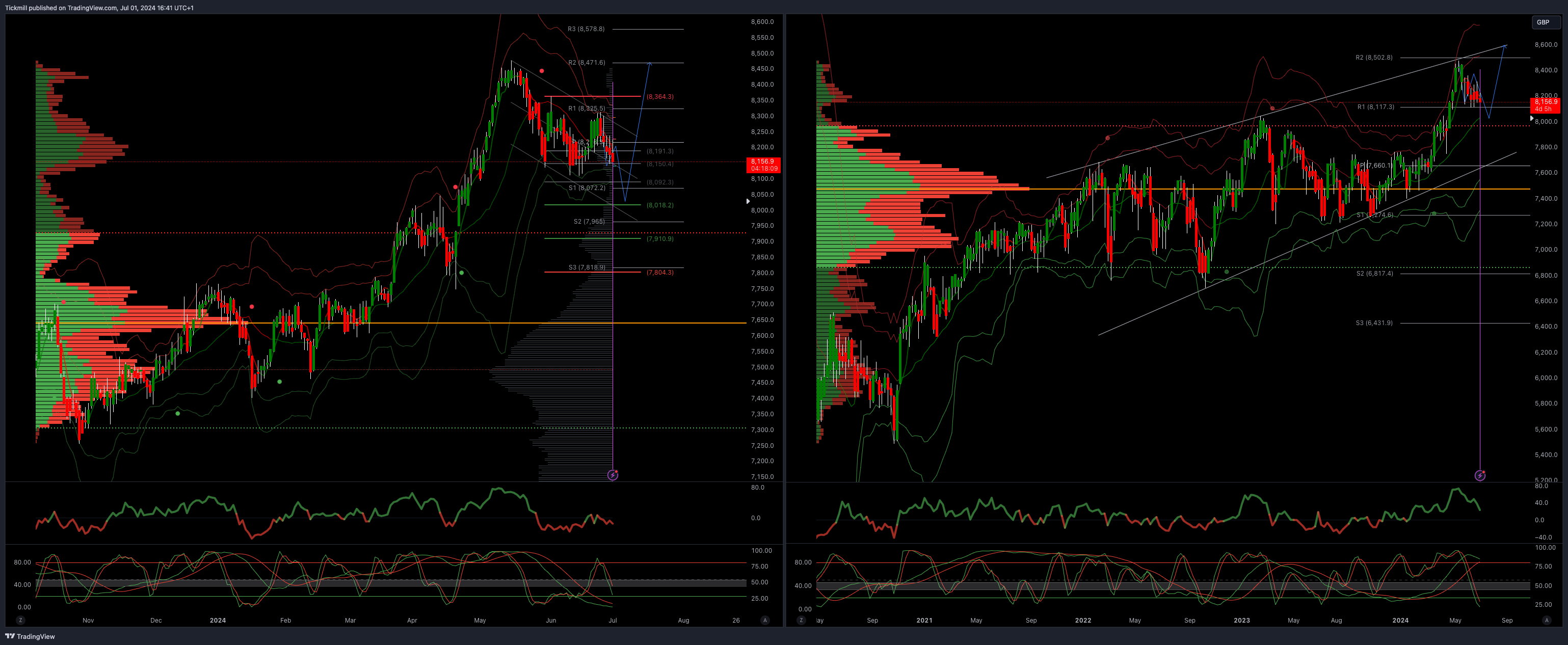

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8300

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!