Reserve Currency Status as a Factor for Medium-term Dollar Decline

The status of reserve currency should be necessarily supported by an economic power of the issuing country as it makes possible for the currency to assume key functions of money - a means of payment and store of value (protection of purchasing power). Within one country, the money is empowered with these functions via monopolisation of the money supply by single body (state) as well as enforcement of their use, covered in the notion of “legal tender”. If we talk about world economy where different currencies exist and no enforcement can be carried out, other natural mechanisms are instead at work, namely:

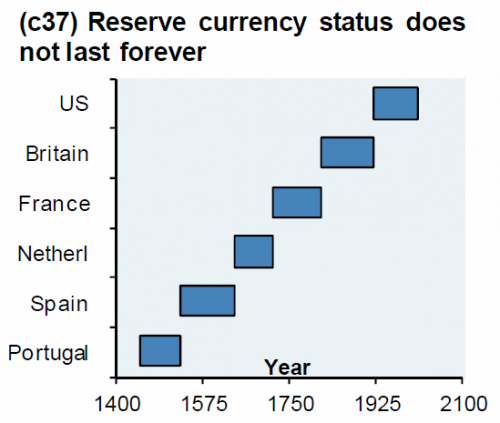

- The dominant share of the country’s GDP in world output and product diversity. The more goods or services you can buy for a reserve currency, and the wider their range, the greater the chance that this currency will become a transnational means of payment. All previous economies, which currencies held the status of reserve, met this criterion, but, oddly enough, only temporarily:

- Low and stable price level growth. Low inflation provides a better protection of purchasing power relative to other currencies, which makes savings in it more attractive;

- Efficient capital markets, which provides a quick and cheap transformation of savings into investments.

From the standpoint of inflation, there are no wide inflation gaps between world powers, like persistently high inflation in US Dollar and low in the Euro what makes Euro more attractive & puts pressure on dollar as reserve currency, as the inflation slackening became global issue. Same with capital markets, US still rocks. But if we talk about economic growth, technological advancement and competition, the dollar losing the role as global means of payment is becoming an increasingly relevant topic for discussion. The July note of Morgan Stanley's investment strategy, entitled “Exorbitant dollar privileges are coming to an end?” was dedicated precisely to the factor of reserve status in the mid-term outlook of the dollar.

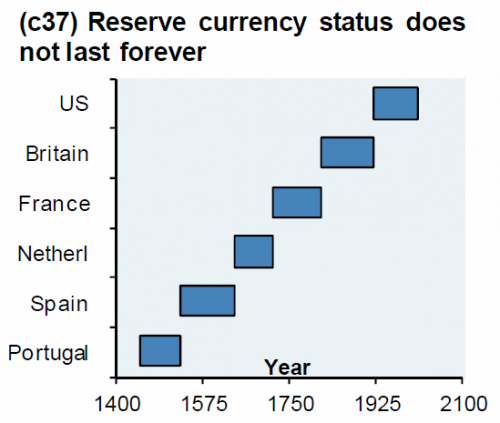

The brief conclusion is that MS analysts have lost faith in the dollar, believing that it will soon lose the status of reserve currency (which will cause its decline in the medium term) due to structural changes and cyclical impediments. After one hundred years of dollar domination, investors have accumulated significant positions in dollars, but feel quite comfortable with this overweight. Diversification makes sense if investors put more weight on Asian currencies and EM, however, to keep it safe, the underlying assets may remain the same, but investment instruments will be denominated in other currencies, which will balance out the FX proportions.

This is the current and recommended currency composition of MS client portfolios:

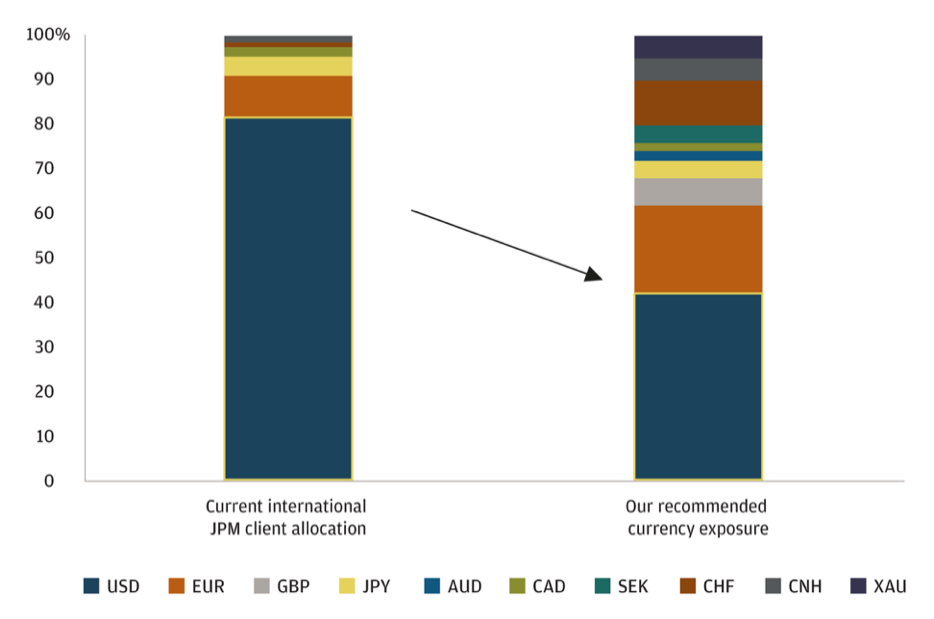

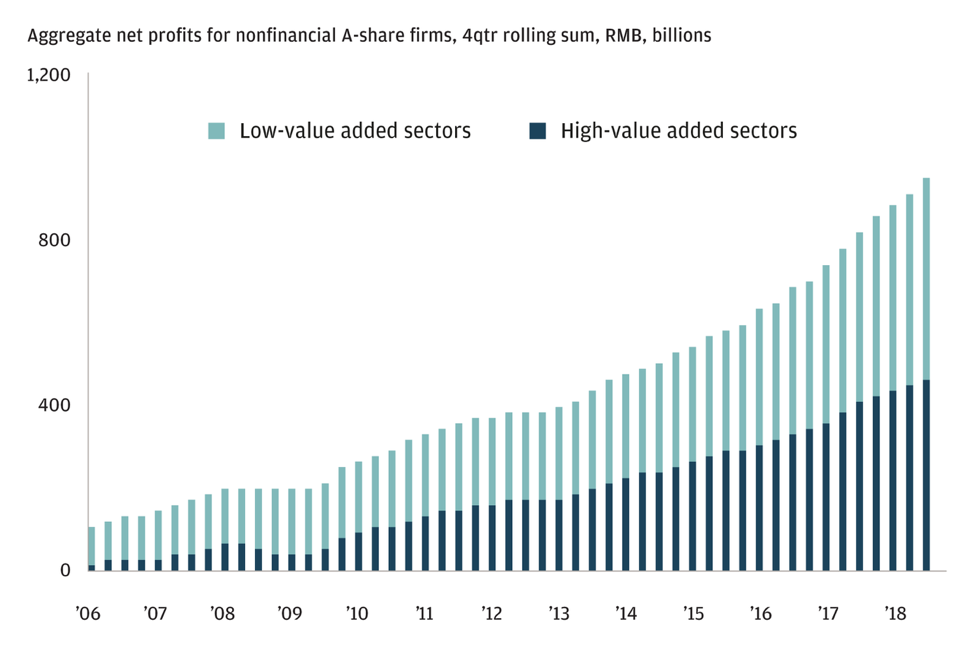

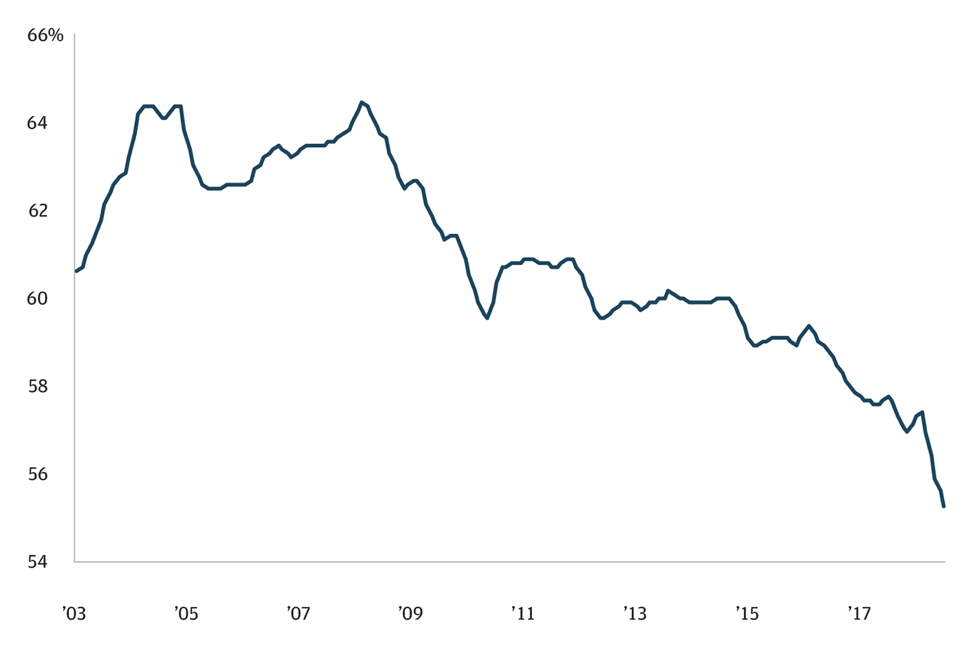

The bank's analysts point out that the accelerated growth rate of China’s GDP at purchasing power parity, as well as the improving balance between low and high value added sectors, create the necessary basis for increasing the share of the yuan in world calculations once the country takes more decisive steps to liberalise the monetary regime:

Source: IMF, J.P. Morgan Private Bank Economics

Source: Bloomberg, J.P. Morgan Private Bank Economics

Over 70 years, China’s GDP has more than quadrupled to 20%, compared with 25% of the United States. The growth of other Southeast economies, such as India, means that the number of transactions in a currency other than the dollar will grow, reducing the relative share of the dollar in the total volume of global transactions. Between 2015 and 2030, the growth of middle-class consumption is estimated at 30 trillion dollars and only 1 trillion dollars will be spent by the middle class of Western economies.

The latest data on central bank reserves show that the share of dollar reserves in the assets of the Central Bank has steadily decreased since 2008:

Source: Exante

However, while the share of global transactions involving the dollar is at a very high level - 85%, the US share in global GDP is only 25%. Strengthening the US position in the oil market suggests that payments for primary products - energy will also be carried out in dollars, which is a strong counter argument to the arguments of JP Morgan, predicting quite swift changes.

What are your thoughts about future dollar dominance? Have your say in the comments section below.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets involves a high level of risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.