Pound Pushing Higher Against USD - What to Watch This Week

UK GDP Boost Continues

The recovery in GBPUSD is continuing to push higher on Monday with the pair now fast approaching a test of the 2025 highs printed earlier in the month. Along with the sharp move lower in USD last week, GBP was also bolstered by news that the UK economy grew more than expected. UK GDP rose 0.5%, up from 0% prior and well above the 0.1% the market was looking for. The rise in activity has helped attract inflows amidst the current environment of de-dollarisation. This dynamic could be amplified this week if the ECB cuts rates again, as expected, driving liquidity away from EUR towards GBP.

UK Data on Watch

However, there are headwinds for GBP this week, in particular the upcoming UK labour market data due tomorrow followed by inflation on Wednesday. If jobs data is seen weakening over the measured period and inflation is seen cooling further on Wednesday, this could cap the rally in GBP turning focus back to expected BOE easing. However, if jobs data was seen rising and inflation surprises to the upside, this could create further pushback against BOE easing expectations creating additional support for GBP near-term given expected ECB easing this week and weakness in USD.

Technical Views

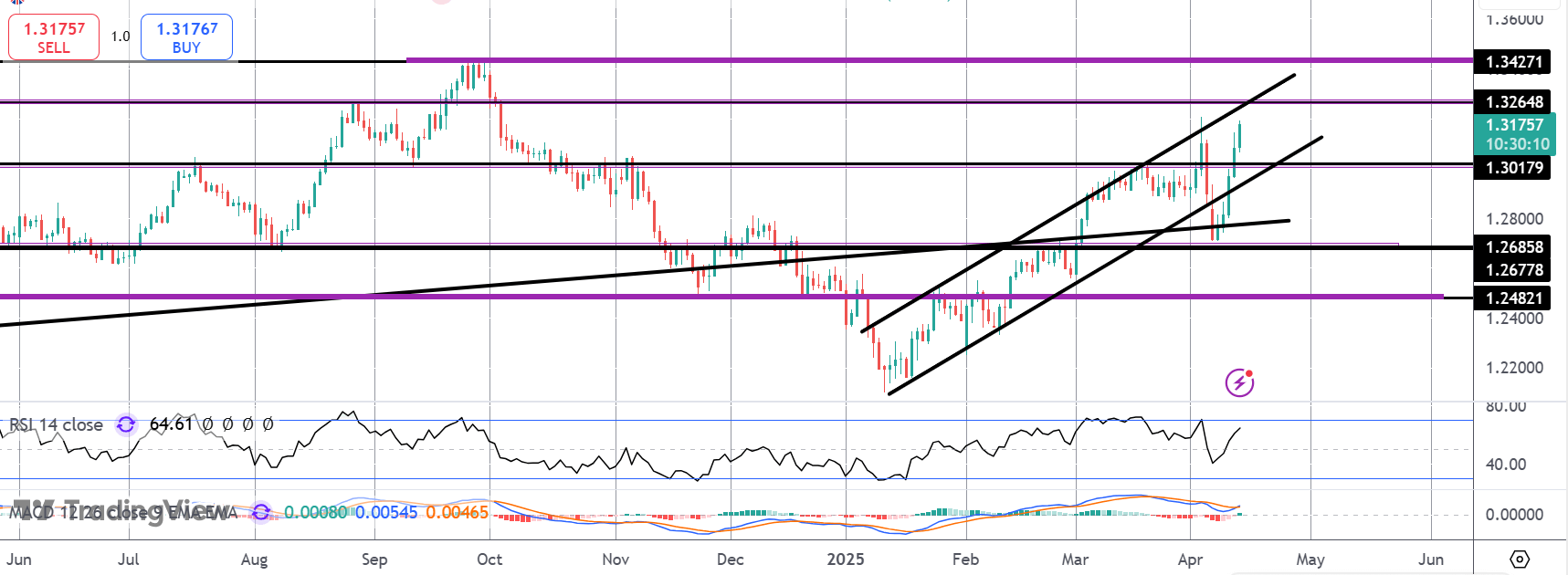

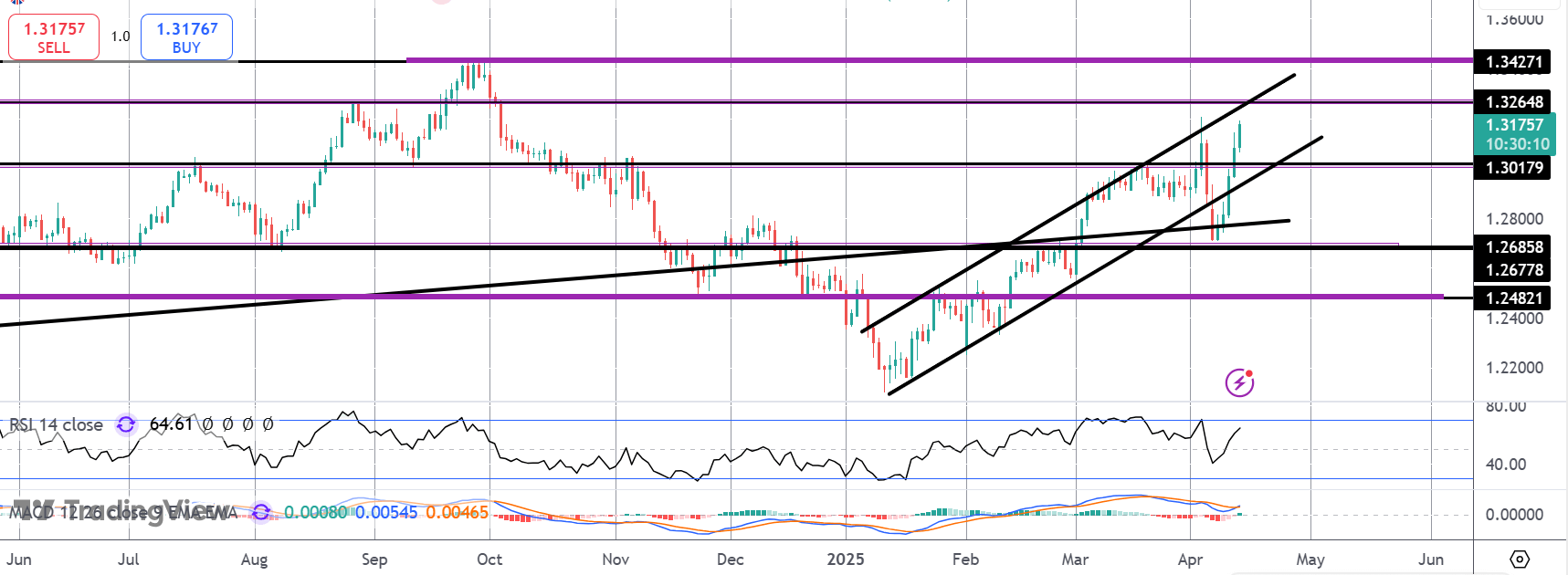

GBPUSD

The rally in GBPUSD has seen the market moving back above the 1.3017 level and with momentum studies bullish, focus is on further upside near-term. However, there is plenty of resistance overhead with the current YTD highs, the bull channel highs and the 1.3264 level resistance all very close above. While we could see some corrective action on first test of this area, the bullish outlook remains while price holds above 1.3017.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.