Market Spotlight: Walmart Shareholders Hoping For More Earnings Growth

Walmart In Focus Today

The big focus for US stock traders today will be the release of Walmart’s Q4 earnings, coming just before the US open. The company’s performance always attracts plenty of attention given its status as an indicator of overall US economic health due to its size. One of the key themes we’ve heard from CEO’s over this earnings season has been the uncertainty and downside risks within the economic outlook for the year ahead. With inflation still at elevated levels and US rates having risen sharply last year, many retailers particularly have highlighted uncertainty in their guidance which is likely to be the message offered from Walmart also.

Market Forecasts

On the numbers front, the market is looking for EPS of $1.51 on revenues of $159.72 billion. Both numbers will mark an uptick on the prior quarter if confirmed, marking a third straight quarter of earnings growth. Importantly, those figures would also mark a solid increase from the same period a year earlier, which should help drive Walmart shares higher near-term provided the forward guidance isn’t too pessimistic.

Technical Views

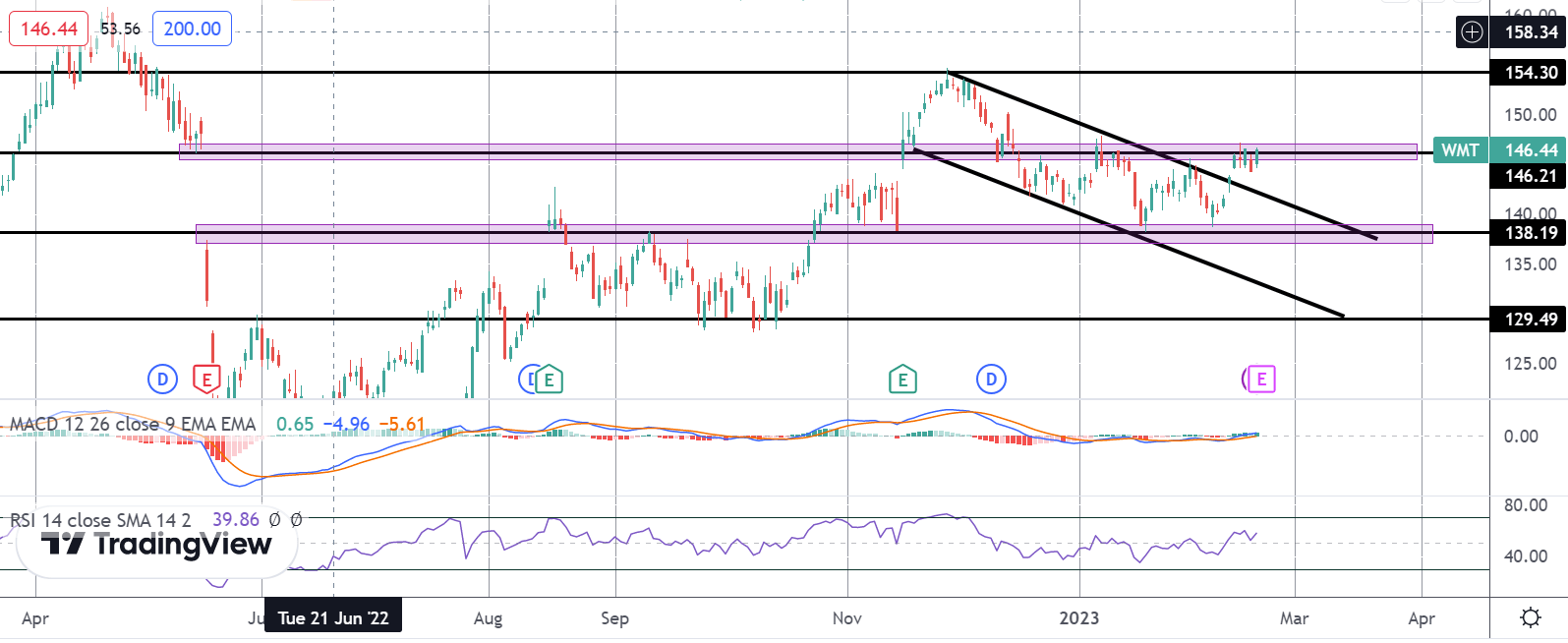

Walmart

The rally in Walmart shares off the 138.19 lows has seen the stock breaking above the bear channel from December highs. Price is now testing 146.21 which is a key level for the market. A break higher here will open the way for a test of the December highs around 154.30. Should price slip back from here, the next support to note is 138.19

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.