Market Spotlight: EURJPY ECB Set Up

EURJPY Pattern Play

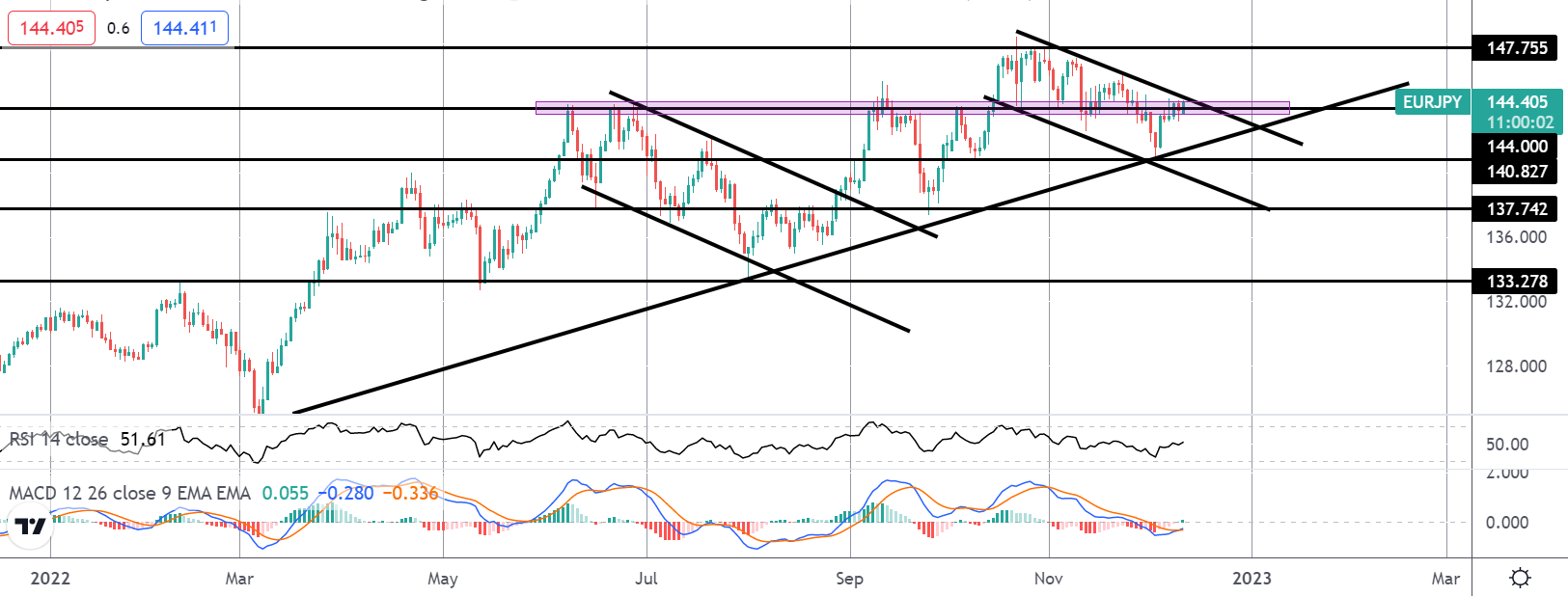

EURJPY price action is looking very interesting here ahead of the ECB meeting this week. The pair has been trading higher this year, underpinned by the rising trend line from the March lows. Similarly to what we saw over June – September, price has recently been correcting lower within a bear channel. Given the broader uptrend, the current move can be viewed as a bull flag, highlighting risks of an eventual break higher as we saw from the last formation.

Two-Way Risk into ECB

Given the event risk on deck with the ECB this week, the pattern looks even more interesting. The ECB is tipped to hike rates by a further .5%. However, on the back of recent eurozone data and hawkish commentary from several ECB members, there are clear hawkish risks going into the meeting. Should the ECB press ahead with a larger hike or signal more aggressive action to come, EUR looks likely to make fresh gains against JPY given the BOJ’s continued commitment to maintaining an easing presence in the market. However, should there be any dovish surprise at the meeting, EURJPY runs the risk of breaking below the rising trend line and correcting deeper still.

Technical Views

EURJPY

Following the bounce off the rising trend line and the 140.82 level, price is now testing the 144 level and corrective bear channel top. If we see a break higher here focus will turn back to the 147.75 level next and a potential break to new highs. To the downside, any move below the 140.82 level will open the way for a test of the 137.74 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.