July ECB Minutes Boost September Easing Calls

ECB Minutes Highlight Dovish Risks

The release of the ECB July meeting minutes has increased expectations that the central bank will announce fresh easing measures when it meets next in September. The minutes revealed that policymakers’ discussions around the outlook for growth and inflation in the eurozone had become more pessimistic. Regarding growth, the minute said it “was also considered that these downside risks had become more pervasive and that their persistence could ultimately also necessitate a revision to the baseline growth scenario”. Meanwhile, regarding inflation, the minutes noted the bank’s concern around declines in both actual and inflation and longer-term inflation expectations which the bank say are “a matter of concern”.

September Easing Expectations Grow

While the minutes do not explicitly say that the bank will ease in September, the tone of the meeting in July reflect that the bank was very close to easing and given the downturn in global and domestic growth as well as the increase in risk factors, September easing now looks likely. The minutes were decidedly dovish, noting that the majority of policy makers are in favour of a multi-pronged approach rather than just single action. The minutes said that a “combination of instruments with significant complementarities and synergies, since experience had shown that a policy package – such as the combination of rate cuts and asset purchases – was more effective than a sequence of selective actions”.

Potential Options

So, what could these actions be?

If the ECB lowers the deposit rate, while this could weaken the EUR exchange rate, it is unlikely to have a significant impact on bank lending. Along with the zero bound bank interest rates currently, this could adversely impact bank profitability.

What might be more effective is a repricing of TLTROs. If TLROs are linked to the deposit rate instead of the MRO this could boost growth in bank lending.

It isn’t clear if lower yields following the restarting of QE could help the economy, though a focus on corporate bonds would boost corporate investment, creating positive spill over effects.

The ECB has made it clear that restarting QE would be a last resort and the diminished returns from new purchases suggest that this is unlikely to be the case. Which suggests that maybe helicopter money could be used, which although wouldn’t boost bank-investment, would support consumer spending.

Summary

What is clear from looking at the different options available to the ECB is that it is in an incredibly difficult position. The bank has demonstrated a willingness to act and has signalled to the market that measures will be taken, meaning that it now has to act, or risk a violent backlash. However, the effectiveness of any new measures is questionable and the ECB itself knows that monetary policy by itself can not solve the problem of low inflation and low growth in the eurozone. Given the deterioration in global conditions and the details of the minutes, a package of measures combining each of the above seems likely.

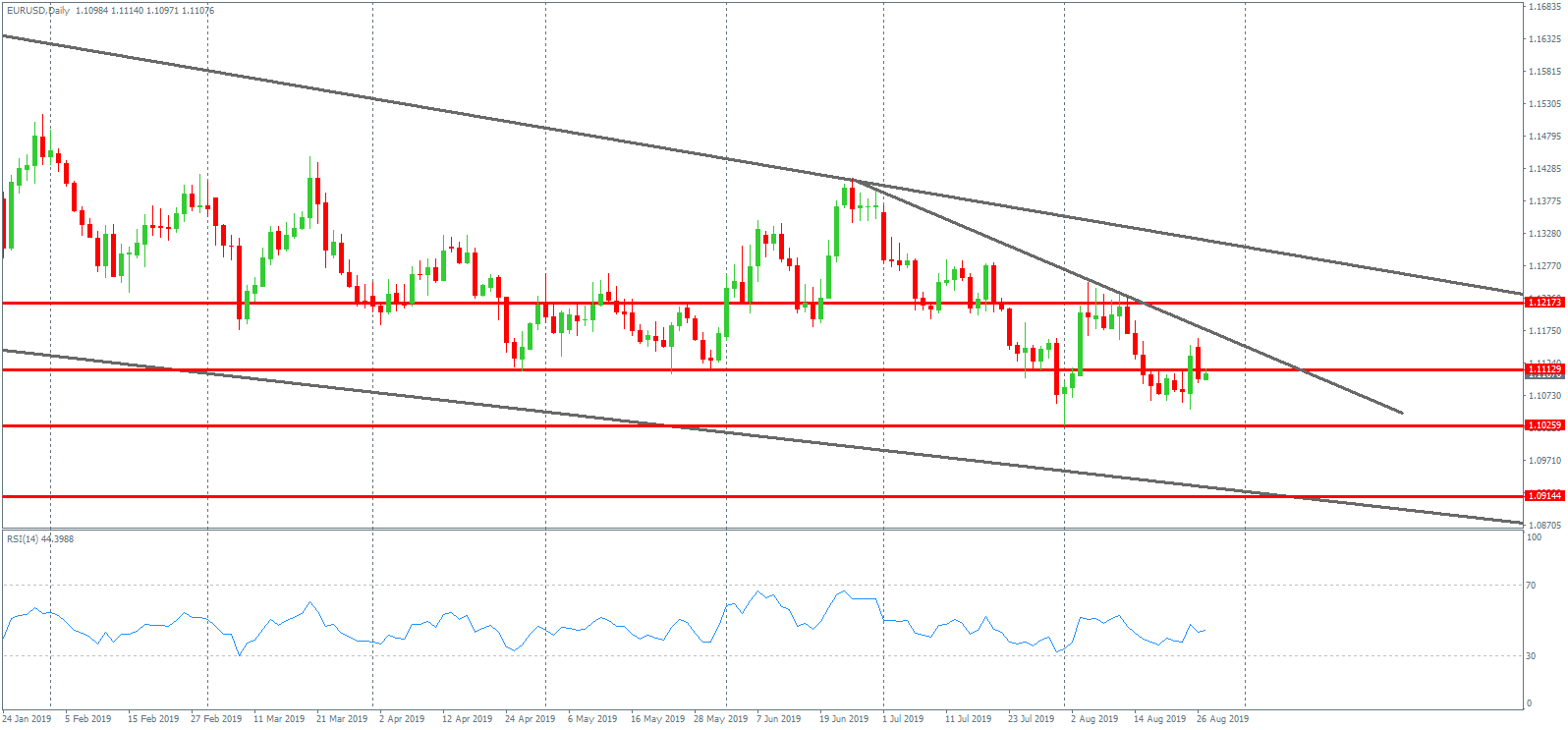

Technical perspective

The bearish trend in EURUSD has lost a great deal of momentum over recent months with price stalling around the 1.1112 level since the start of Q2. The current higher low in place against the 1.1025 level suggests the risk of a squeeze higher, supported by the divergence in the RSI indicator. Bulls will need to see a break of the local bearish trend line from June highs though bigger structural resistance is ahead at the 1.1217 level.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.