Is Gold At Risk of A Deeper Reversal?

Downside Risks Seen for Gold?

Gold prices are on watch this week with the futures market at risk of carving out a double-top, lower-high formation following the reversal lower from last week’s highs. Uncertainty around the Fed has capped the strength in gold for now with pricing for a December rate cut falling from around 95% pre-FOMC to below 50% today. Hawkish comments from Fed policymakers last week have further weighed on traders’ dovish expectations as markets await all the delayed shutdown-period US data to come starting with the September NFP on Thursday.

NFP Implications

If we see data rising as expected, and especially if we see an upside surprise, this should further weigh on gold near-term as traders scale back easing expectations further. However, if data undershoots forecast, this should revive December easing expectations, creating fresh demand for gold as USD falls.

FOMC Minutes

Along with the September NFP report, we’ll also get the October FOMC minutes this week. Given the hawkish revelation from Powell and his comments on a lack of support for further easing, there are clear downside risks for gold into this release. The extent to which gold sells off in response to any hawkish details might be limited ahead of the employment data on Thursday. However, if that data comes in hot, that should amplify any USD bullishness, putting greater pressure on gold.

Technical Views

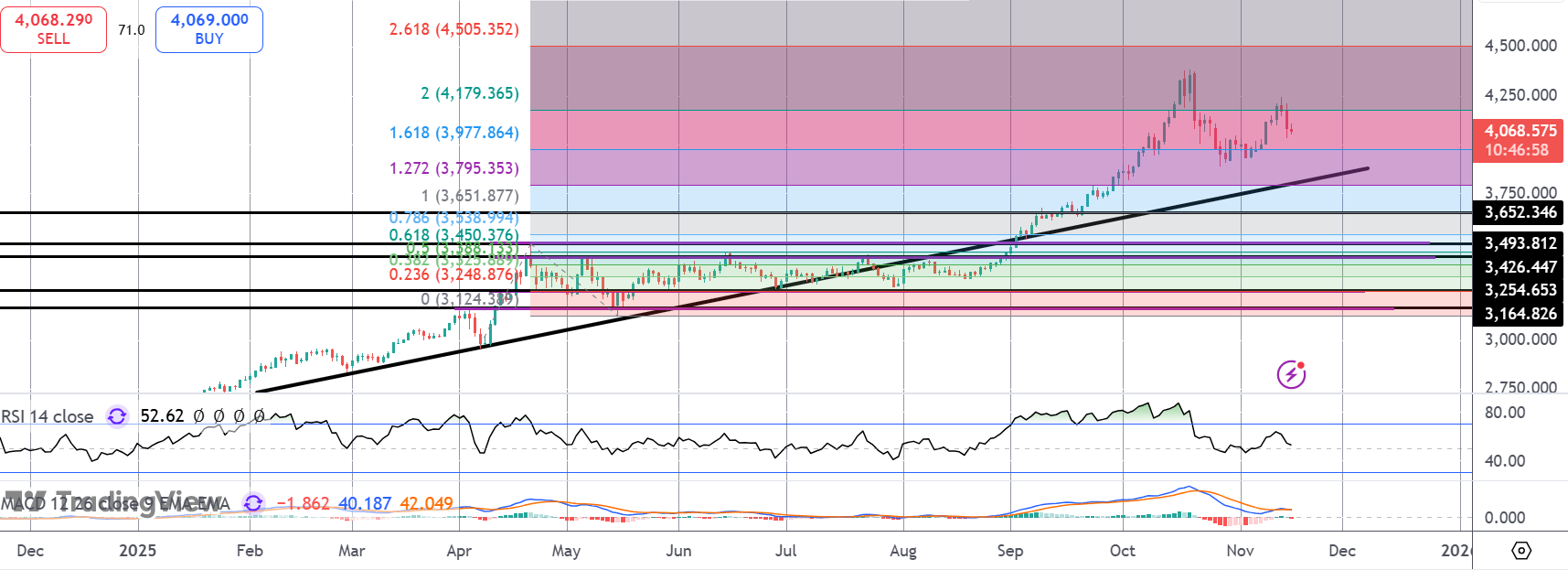

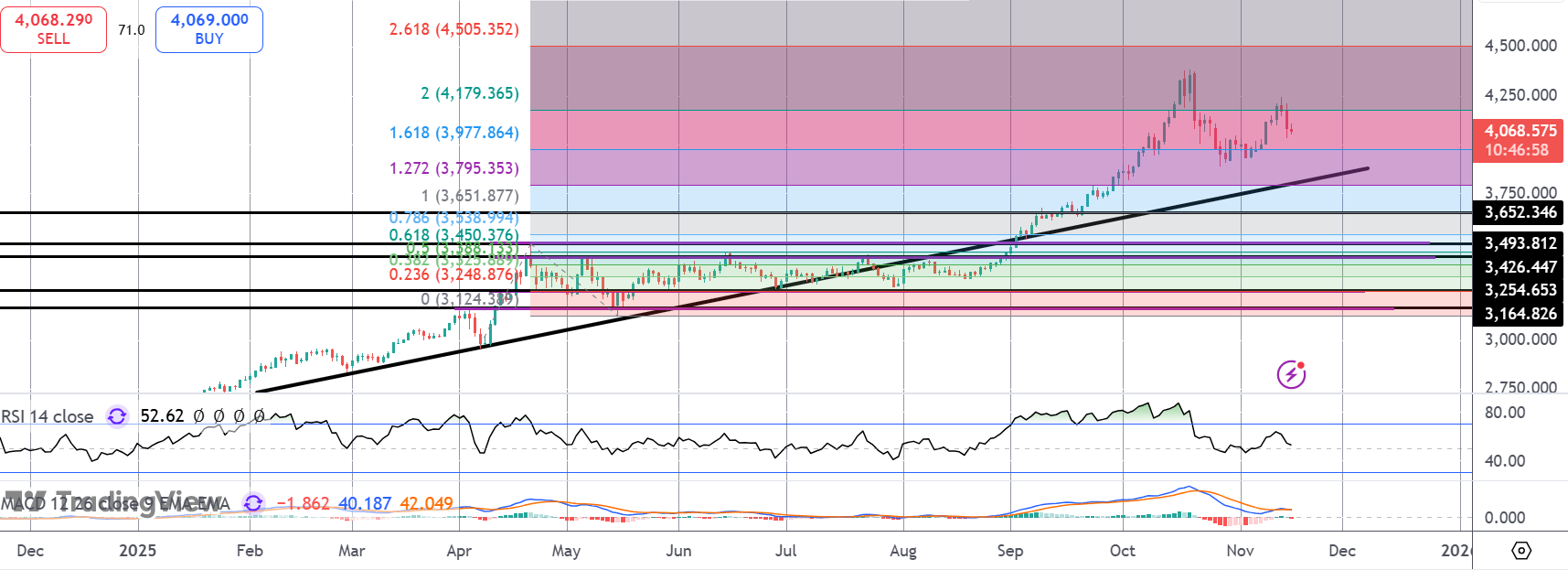

Gold

The failure and reversal at 4,200 might prove an important development for gold. With the risk that gold is forming a double-top, lower-high here, downside risks are seen. The late October lows around 3,900 will be the initial support level to watch with the bull trend line below the next marker to watch if we push lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.