Institutional Insights: JPMorgan - Take Profit On Certain USD Shorts

.jpeg)

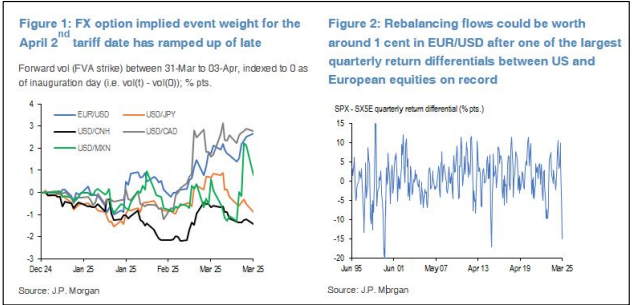

JPMorgan FX Research Team , are taking profits on certain USD short positions ahead of the critical April 2nd tariff announcement and the residual quarter-end rebalancing flows.

In the medium term, we maintain a bearish outlook on the USD, driven by expectations of moderating U.S. exceptionalism, a shift from carry to value, and growth catalysts in the rest of the world (RoW), such as Eurozone fiscal policy initiatives.

We are closing USD short positions against NOK, SEK, and AUD while maintaining USD shorts in DXY form and against EUR. We also continue to hold JPY longs and Scandi longs versus EUR.

In our FX weekly publication, we explored potential USD impacts under various tariff scenarios, including VAT, universal, sectoral, and reciprocal tariffs. While broad VAT and universal tariffs may initially boost the USD, these scenarios are also the most detrimental to U.S. growth relative to RoW. As such, while the market may fade initial USD strength, we are opting to partially reduce our USD short exposure (specifically against NOK, SEK, and AUD) due to heightened uncertainty surrounding the event. Our remaining USD shorts are concentrated in a DXY basket and against EUR and JPY. We also continue to hold JPY longs (against NZD, CHF, USD, and EUR) as a safe haven to hedge tariff risks, especially if they exert downward pressure on U.S. yields.

While we are taking tactical profits on our NOK exposure versus USD, we are maintaining NOK longs against EUR for several reasons, including this week’s Norges Bank meeting. A hawkish outcome could support NOK against USD, but short-term positioning, flow dynamics, and event risks justify some risk management in our exposure. Similarly, the decision to take profits on the SEK leg of the USD short (versus the EUR-SEK basket) is informed by these considerations, as well as the ongoing dividend season in SEK, during which the krona historically prices in bearish flows.

Regarding tariff risks, we revisit insights from our FX year-ahead publication, which identified NOK as one of the currencies least exposed to tariff-related risks. This is partly due to Norway’s low manufacturing share of GDP (6%). Last week’s Regional Network Survey also indicated that trade uncertainty is not expected to significantly impact activity in H1-25. SEK, too, is relatively shielded compared to EUR. Earlier in March, we initiated NOK longs versus EUR and USD to capitalise on what we saw as a laggard in a broader context of European cyclical repricing, U.S. moderation, equity rotation, and carry-to-value shifts.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!