US Weekly Kickstart

Policy uncertainty and market volatility create risk to the much anticipated rebound in capital markets activity

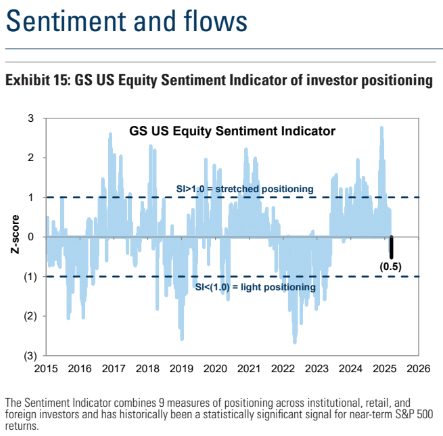

The S&P 500 entered a -10% correction territory this week as investors assessed the impact of policy uncertainty on the economic outlook. In response, we have revised down our S&P 500 earnings estimates and lowered our year-end price target to 6200, which still represents a 10% upside from current levels.

Given the softer macroeconomic and market environment, we have also reduced our forecast for 2025 US M&A volume growth to +7% (previously +25%). Our model for completed M&A activity is based on US economic growth, CEO confidence, and changes in financial conditions. A scenario involving heightened tariff risks, slower economic growth, and diminished confidence could result in a contraction in completed M&A activity.

Announced M&A activity has increased by 15% year-over-year, reflecting a steady growth rate, though it falls short of the post-election surge anticipated by many market participants. To date, 152 US M&A transactions exceeding $100 million have been announced this year, aligning with the 15-year average.

Our IPO barometer nowcast indicates a reading near 100, suggesting IPO activity is consistent with historical averages. So far this year, there have been 12 IPOs raising over $25 million, matching last year’s pace.

The performance of stocks tied to capital markets activity indicates fading post-election optimism for a broad-based surge. Stocks of alternative asset managers, advisors, and investment banks rose by 13% (compared to +3% for the equal-weight S&P 500) between Election Day and January’s end but have since declined by 23% (versus -7% for the equal-weight S&P 500).

This downside risk to capital markets also poses challenges for one of the key arguments supporting large-cap Banks. Post-election, Banks were viewed as near-term beneficiaries of increased capital markets activity, stronger US economic growth, and deregulation. While the economic and market outlooks have weakened, our Banks analysts remain optimistic about the profitability boost from deregulation. Historically, a 1.5 percentage point increase in ROE has been associated with a 0.5x lift in P/B multiples, suggesting potential valuation upside for Banks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!