Institutional Insights: Goldman Sachs Nvidia Earnings

.png)

Institutional Insights: Goldman Sachs, Nvidia Earnings

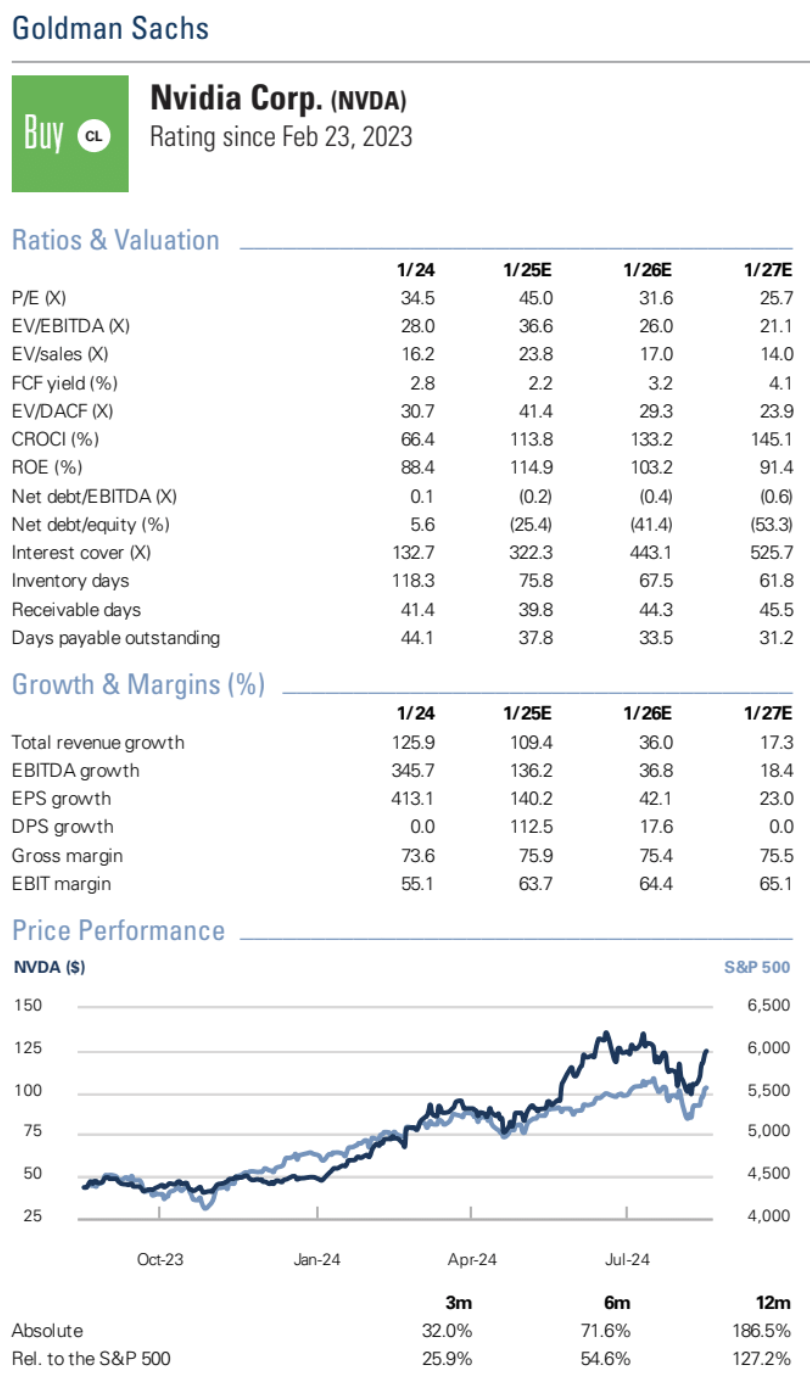

Analysts at Goldman Sachs 'reiterate a Buy rating on NVDA (also on the Conviction List)ahead of FY2Q (July) results scheduled for August 28 (post market close). While the reported delay in Blackwell (i.e. next-generationGPU architecture; could lead to some near-term volatility in fundamentals, we expect management commentary coupled with supply-chain data points over the coming weeks to lead to higher conviction as it pertains to Nvidia’s earnings power in CY2025 (note our CY2025 non-GAAP EPS [excl. SBC]estimate of $4.16 is 11% above Street consensus). Importantly, we believe customer demand across the large Cloud Service providers and enterprises is strong and Nvidia’s robust competitive position inAI/accelerated computing remains intact. From a stock perspective, we believe the set-up for NVDA is constructive with the stock trading at 42x NTM consensus EPS or a relative premium of only 46% (vs. its past 3-year median of 151%) and our updated Bull/Bear Framework indicating a favorable risk/reward balance.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!