Dollar Softens On Fading Trade Deal Optimism

USD Weaker on Thursday

The US Dollar remains a little softer on Thursday with DXY still down from the weekly highs following the rally we saw on Monday in response to news of the US/China tariff reduction deal. It seems that the news wasn’t enough to spark a fuller USD rally with traders waiting on fresh positive headlines to stoke demand. On Tuesday, a softer-than-expected US inflation reading was seen fuelling the reversal lower in DXY with traders mulling the prospect of a less inflationary environment than previously anticipated. While rate-cut projections remain pushed out at this point (market pricing currently favours a September cut), this could shift if we see inflation continue to cool. If the next CPI reading is lower again, and US/China trade talks look to be progressing this could see pricing shift in favour of a July cut again, further weakening USD.

US Data & Powell Comments

Looking ahead today, traders will be watching a slew of US data with PPI, retail sales, weekly jobless claims and both Empire and Philly manufacturing due. Alongside these releases, we’ll also hear from Fed chairman Powell who is scheduled to speak later. On the data front, any weakness in PPI and retail sales should feed into current USD bearishness. Regarding Powell, given that recent commentary from him has tended to be relatively neutral, traders will be keen to see if his view has shifted at all on the back of that inflation reading. If so, USD could move lower today in response to any perceived dovishness from Powell.

Technical Views

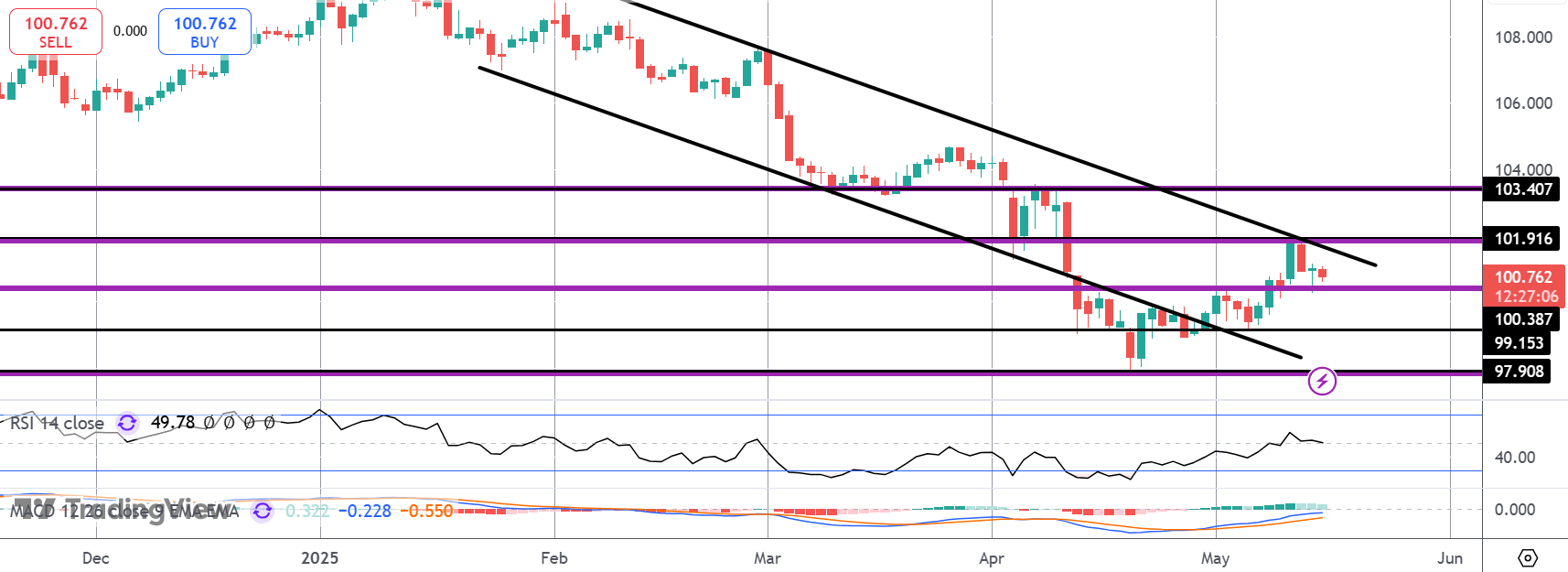

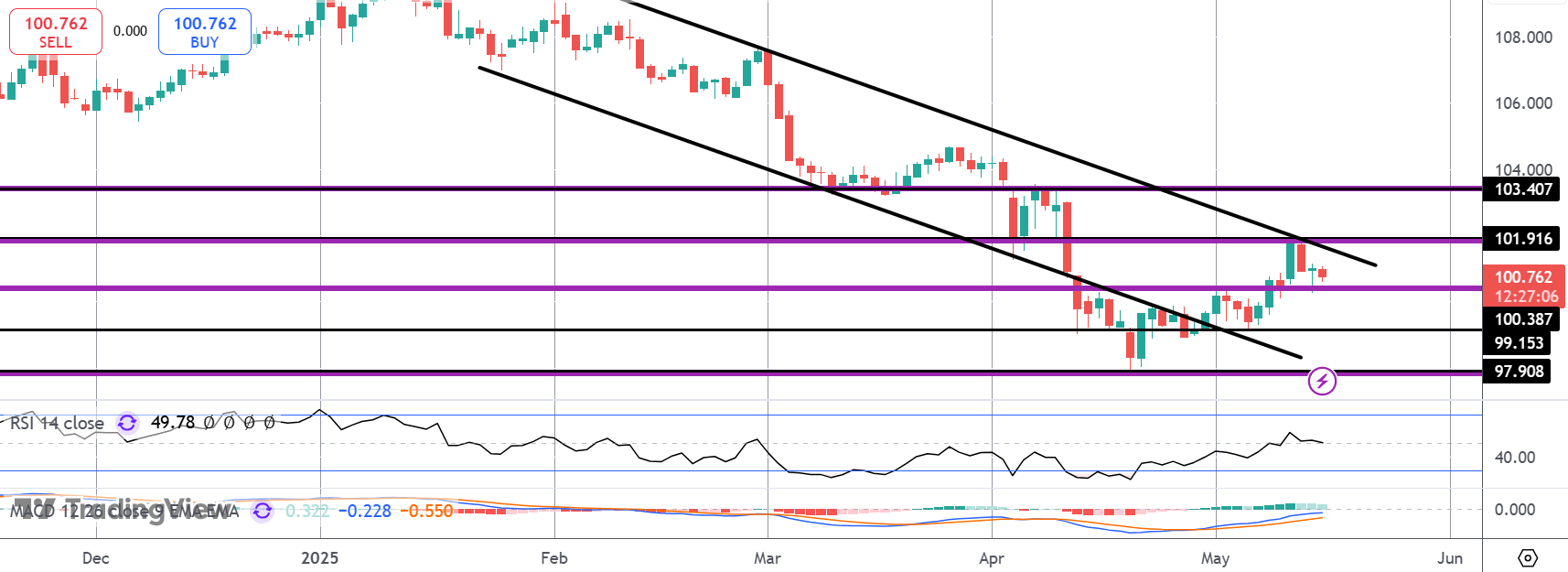

DXY

For now, the rally in DXY has stalled into the 101.91 level and the bear channel highs. Price is currently sitting back on support at the 100.38 level. If broken, focus will shift to 99.15 and 97.90 as deeper supports to watch. Above 101.91, 103.40 will be the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.