Daily Market Outlook, July 11, 2023

Daily Market Outlook, July 11, 2023

Munnelly’s Market Commentary…

Asian equity markets experienced positive performance, driven by modest gains on Wall Street. Cyclicals benefited from promising inflation indicators ahead of the upcoming US CPI data, while market participants also considered China's support measures. The Nikkei 225 remained flat and struggled to maintain its early momentum due to a stronger currency. However, Sumco stood out as it outperformed other stocks following reports that the government would potentially provide the company with a subsidy of up to USD 530 million to enhance wafer capacity. Nonetheless, Industry Minister Nishimura later denied these reports. In contrast, the Hang Seng index and the Shanghai Comp. posted gains. This positive sentiment was primarily driven by developers who benefited from the news that China would extend two financial policies supporting the stable and healthy growth of the real estate market until the end of 2024.

This morning, the latest UK employment market report was released, providing crucial insights into domestic inflationary pressures. The report revealed that regular wage growth (excluding bonuses) for the three months up to May exceeded expectations, standing at 7.3%. This figure is likely to be viewed as too hot by most Bank of England policymakers. While employment growth slowed, it was not as significant as anticipated. However, the unemployment rate rose from 3.8% to 4.0%, partly due to previously "economically inactive" individuals reentering the job market. This influx is expected to alleviate some of the tightness in the employment market. Nonetheless, the headline read on the report is the stronger-than-expected wage growth.

For European investors the German ZEW survey will give an early indication of economic trends for July. Although this survey targets financial experts rather than businesses, it aims to gauge both current economic conditions and expectations for the next six months. For the July ZEW survey, it is anticipated that both the current situation will print -63 and expectations -19. Other surveys have indicated a slowdown in activity in Germany, particularly in manufacturing, as companies grapple with rising interest rates.

Stateside, the NFIB small business optimism index is expected to show a slight increase from 89.4 to 89.9, according to consensus forecasts. However, all attention will be focused on tomorrow's Consumer Price Index (CPI) inflation report, which is expected to indicate a decline in the headline measure but reveal more persistent underlying "core" inflation.

CFTC Data As Of 07-07-23

USD net spec short pared in Jun 28-Jul 3 period, $IDX +0.58% in period

EUR$ -0.77% in period, specs -2,191 contracts into dip, now +142,837

$JPY +0.3% in period, specs -5,050 contracts on diverging rates now -117,920

GBP$ -0.29%, specs -1,729 contracts, now +50,265; less-dovish Fed lifts USD

$CAD +0.21% specs +7,374 contracts flip position to +4,527

AUD$ +0.09% in period, specs -5,158 contracts now -44,582

BTC +0.5% in period specs +18 contracts now short 2,076 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0890-1.0900 (2BLN), 1.0925 (466M), 1.0950-55 (1BLN)

1.0970-80 (691M), 1.1050 (307M)

USD/CHF: 0.8980-0.8900 (458M)

GBP/USD: 1.2720-25 (312M), 1.2760-70 (358M)

USD/JPY: 142.50 (250M), 143.00 (420M)

Overnight News of Note

Australia June Business Conditions Steady In Sign Of Resilience

China To Accelerate Policy Roll-Out To Aid Property Sector - CSJ Citing Analysts

Japan FinMin Suzuki: Arranging G7 Meet On Sidelines Of G20

Fed’s Williams Says He Does Not Have A Recession In His Forecast

Fed’s Bostic: Should Wait Before More Interest-Rate Hikes

Fed's Mester: More Hikes Needed To Bring Inflation Back Down To Target

ECB's Nagel Sees Hard Landing Avoided Though Growth May Slow

UK Chancellor Hunt Says Government And BoE Will Tame Inflation

French Central Bank Keeps Forecast For 0.1% Q2 Growth

USD/JPY Plummets To Fresh Multi-Week Low, Amid Broad-Based USD Weakness

Microsoft Confirms More Job Cuts On Top Of 10K Layoffs Announced In Jan

Wall Street Banks Court Sovereign Funds For Syngenta’s Mega IPO

Uber CFO To Step Down In Most Senior Executive Exit Since IPO

TSMC To Start Building Second Japan Plant In April

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

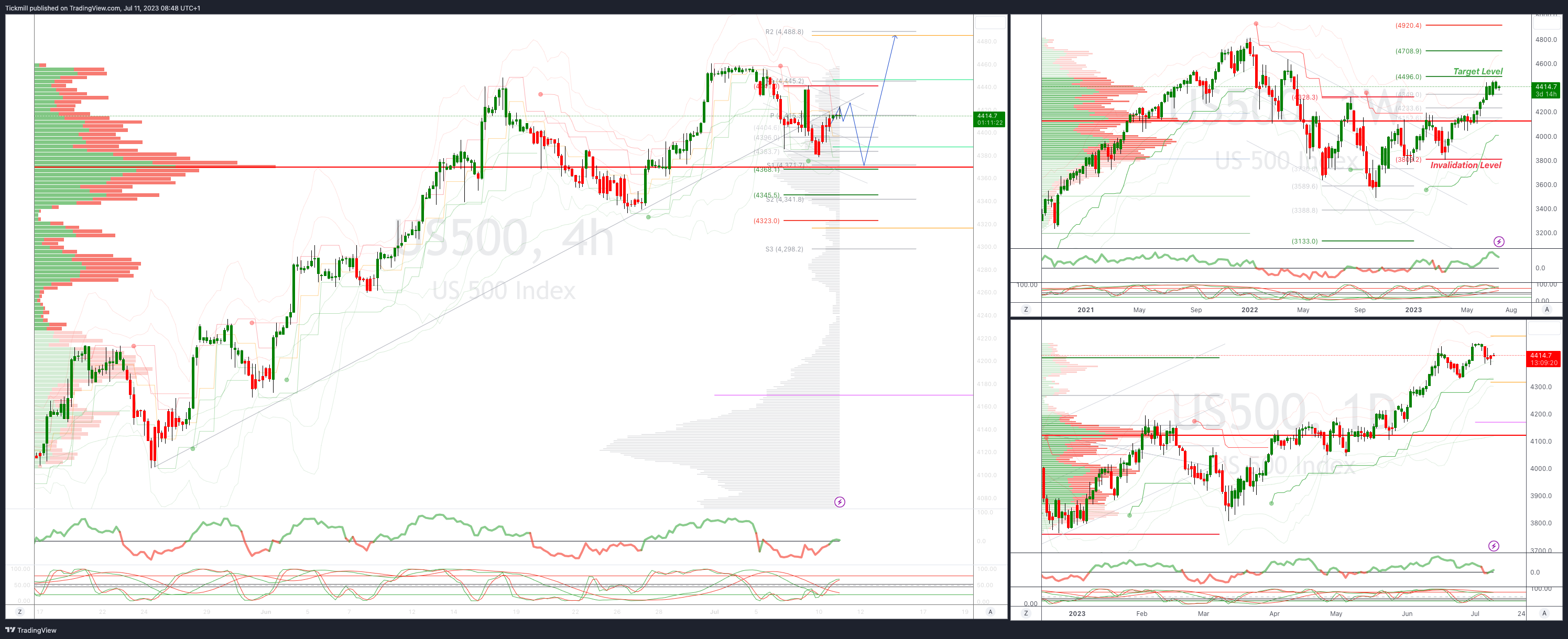

SP500 Bias: Intraday Bullish Above Bearish Below 4365

Below 4350 opens 4330

Primary support is 4300

Primary objective is 4484

20 Day VWAP bullish, 5 Day VWAP bearish

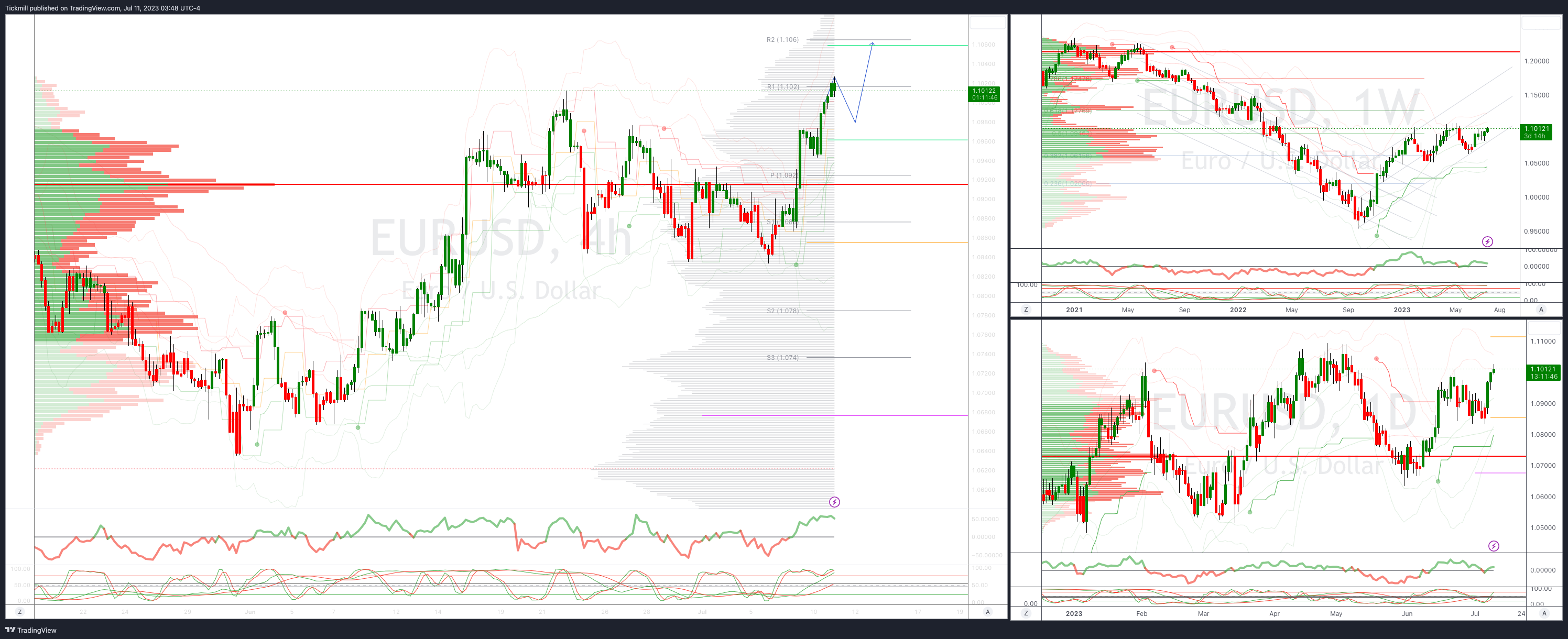

EURUSD Intraday Bullish Above Bearsih Below 1.0950

Below 1.0890 opens 1.0830

Primary support is 1.07

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

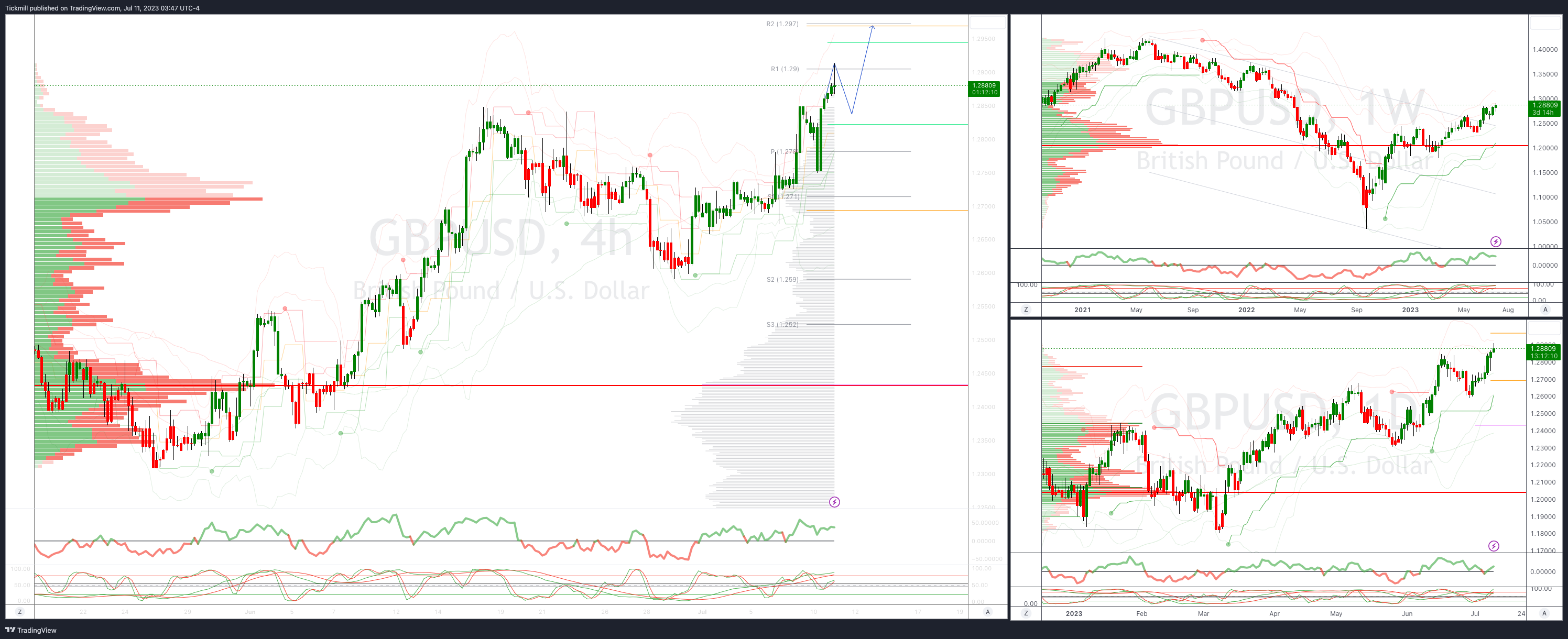

GBPUSD: Intraday Bullish Above Bearish Below 1.2750 Target Hit, New Pattern Emerging

Below 1.2730 opens 1.268

Primary support is 1.26

Primary objective 1.2970

20 Day VWAP bullish, 5 Day VWAP bullish

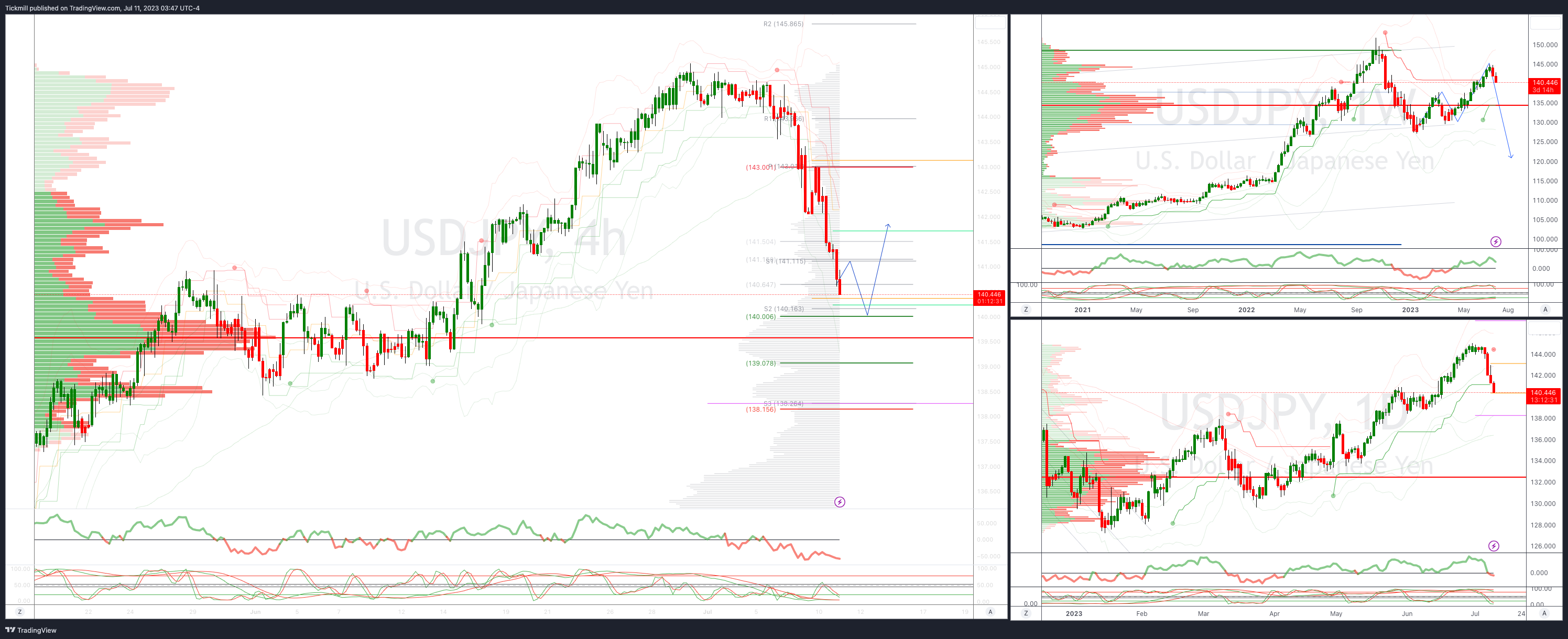

USDJPY Bullish Above Bearish Below 143

Above 143 opens 144

Primary support is 140

Primary objective is 140

20 Day VWAP bullish, 5 Day VWAP bearish

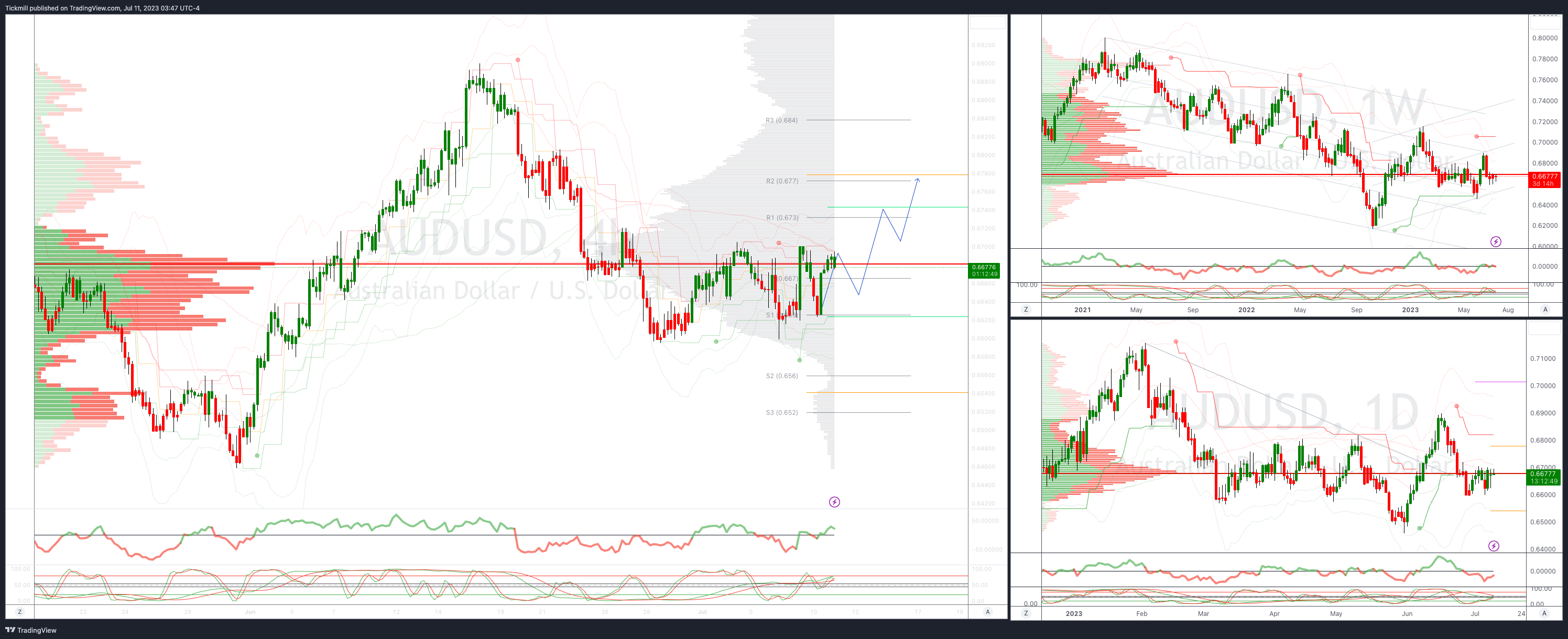

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

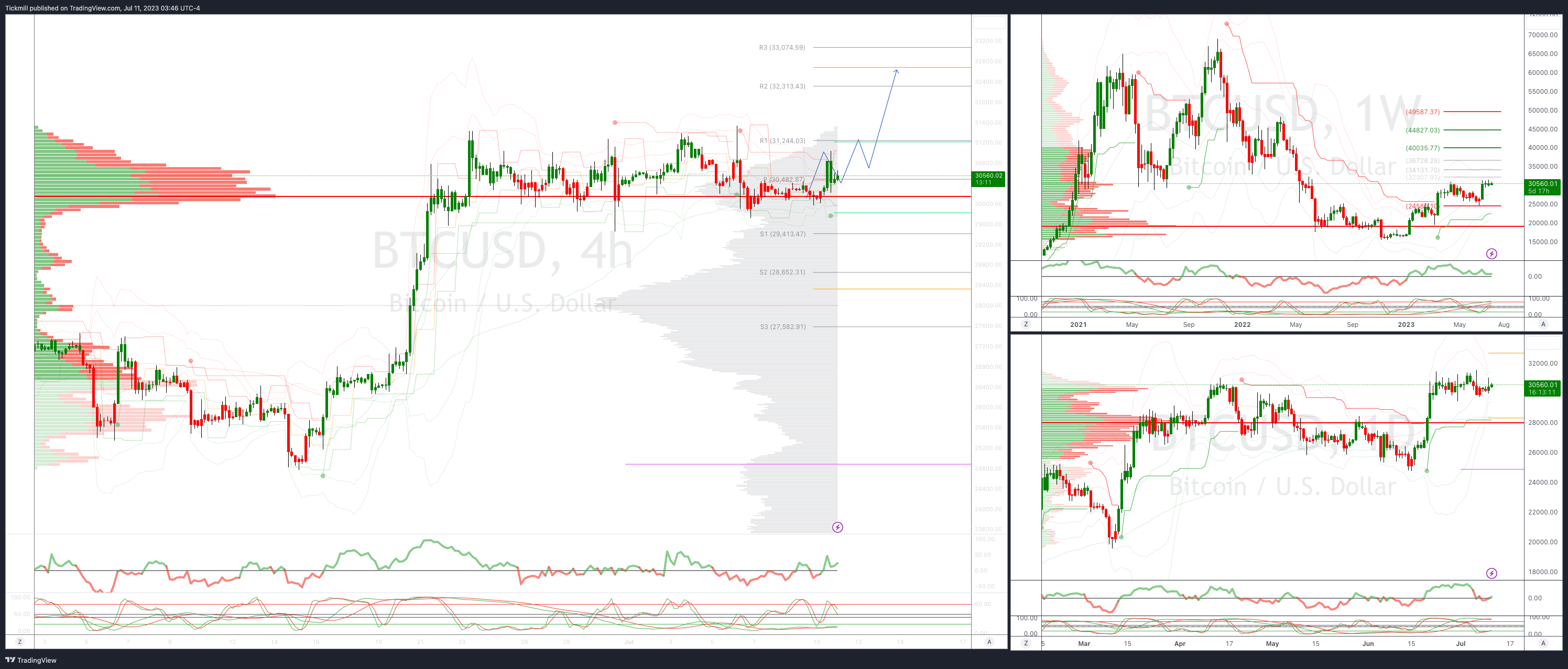

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!