Daily Market Outlook, January 18, 2023

Daily Market Outlook, January 18, 2023

BoJ Double Down or Bust

The Bank of Japan has once again remained anchored to their easy monetary stance, frustrating bond traders who had been poised to profit from an about turn in Yield Curve Control policy, the Japanese Yen shed 2% as the Nikkei ascended by a similar amount. The BoJ stated its intention to continue to purchase bonds at whatever amounts required to maintain the much maligned 0% yield on 10 year JGB, hence, the trading band is maintained at -0.5%/+0.5%, the central bank has deployed billions to defend the ceiling in recent trading sessions, the 10 year yield retreated from a high of 0.51% back towards 0.35% on the announcement.

Market watchers now see the BoJ left having to purchase record amounts of domestic debt, essentially making them the prime source of liquidity backstopping the debt markets, this move may be considered a last chance saloon scenario for investors still holding JGB exposure, to exit at reasonable levels before the appointment of a new BoJ Governor and an official reorientation in the Yield Curve Control strategy.

UK CPI inflation data released earlier this morning showed that inflation pulled back front he peak of 10.7% to print 10.5% in December inline with market expectations, the majority of the retreat is attributed to the decline in petrol prices, market watchers now look for further declines in food and energy prices next month as the UK market begins to aline with other developed economies, looking past the peak in inflationary pressures, however, the UK economy continues to witness a very tight employment market and general domestic pressures remain stubbornly elevated, this combination will likely keep the Bank of England on course for its tenth consecutive rate increase at its next meeting.

In the Eurozone investor focus this morning will be the final print for December inflation data which is expected to confirm a back to back monthly decline in consumer prices, however, recent rhetoric from European Central Bank officials suggest they have set a course for further restrictive monetary policy, with markets currently pricing another 50bps move at the February meeting

In the US all eyes will be on retails sales and industrial production data both of which are expected to show continued weakness, industrial production is set to have taken a hit from significant winter storms seen stateside. On the retail sales side of the ledger weakness is expected to be driven by record declines in the used car sales market. The US data slate is rounded out today with Producer Prices data which is expected to follow CPI’s lead and show a build in disinflationary pressures for Producers, investors will have one eye on the wires as Fed officials are set to make further remarks today.

Markets-wise, investors will continue to monitor moves in the bond markets and the JPY remains in focus, the US 10yr continues to rotate around the 3.5% with the Dollar Index anchored around the 102 handle. Commodity markets remain supported with many investors eyeing the breakout in WTI Crude taking out resistance at the $80 a barrel level, $83.50 is the next level of interest, Gold continues to shine, bulls will be looking for the yellow metal to remain supported above 1890 for a move to test 1950 next!

Overnight News of Note

Asian Shares Mixed After BoJ Keeps Yield Policy Unchanged

BoJ Holds Policy As It Pushes Back Against Market Speculation

BoJ Introduces Latest Weapon To Defend Yield Control Policy

Yen Slumps, Bond Futures Rising As Yield-Curve-Control Stays

Goldman Sachs Lift China Economic Growth Forecast To 5.5%

Bitcoin Has Now Recovered All Its Losses Since FTX Collapsed

Oil Pushes Higher On Bets Chinese Demand Will Surge This Year

Gold Slips As Dollar Gains Momentum, Focus On Data Releases

Fed’s Barkin Says Too Soon To End Hikes As Inflation Lingering

White House: No Debt Discussions After McCarthy Urges Talks

US Sec Blinken: Iran Rejected Chance to Revive Nuclear Accord

ECB’s Villeroy Says Resilient Economy Makes Rate Hikes Easier

UK Pay Deals Steady For Second Month As Wages Lag Inflation

Scholz Sees Germany Riding Out Ukraine War, Avoid Recession

Apple Delays AR Glasses, Plans Cheaper Mixed Reality Headset

Microsoft To Axe Thousand Of Jobs In Latest Cull By Tech Giant

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 3950

Primary support is 3950

Primary objective is 4022

Below 3940 opens 3890

20 Day VWAP bullish, 5 Day VWAP bullish

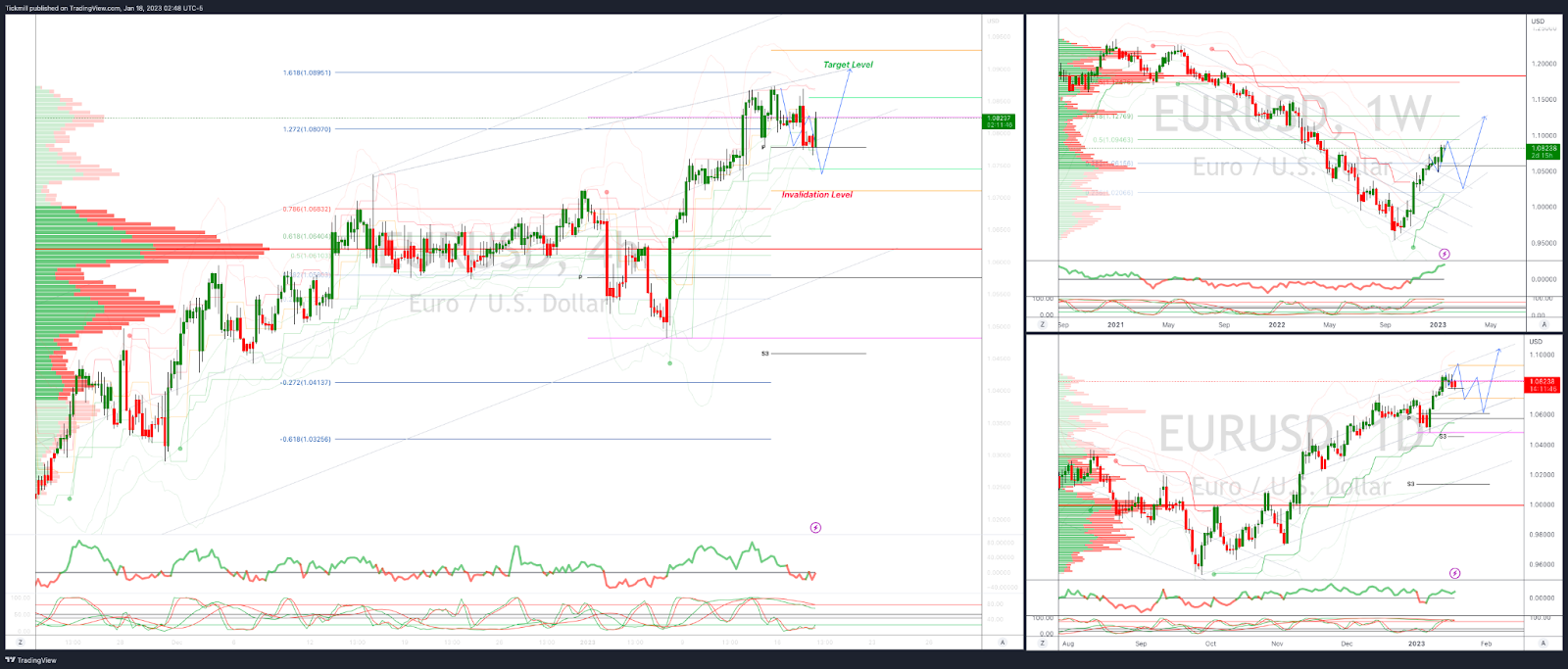

EURUSD Bias: Bullish Above Bearish below 1.0735

Primary support is 1.0735

Primary objective is 1.09

Below 1.0730 opens 1.0610

20 Day VWAP bullish, 5 Day VWAP bullish

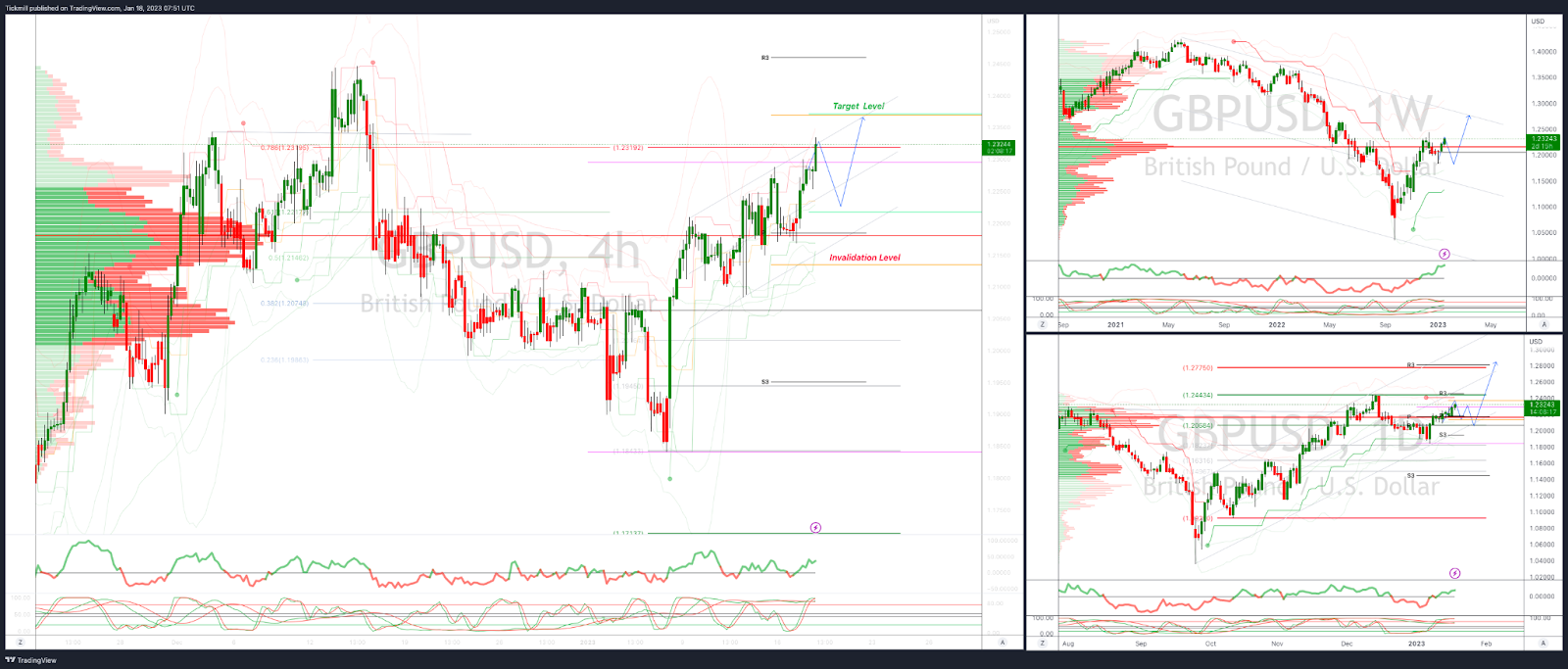

GBPUSD Bias: Bullish Above Bearish below 1.2230 -123.15 Target Hit New Pattern Emerging

Primary support is 1.2230

Primary objective 1.2370

Below 1.2140 opens 1.2080

20 Day VWAP bullish, 5 Day VWAP bullish

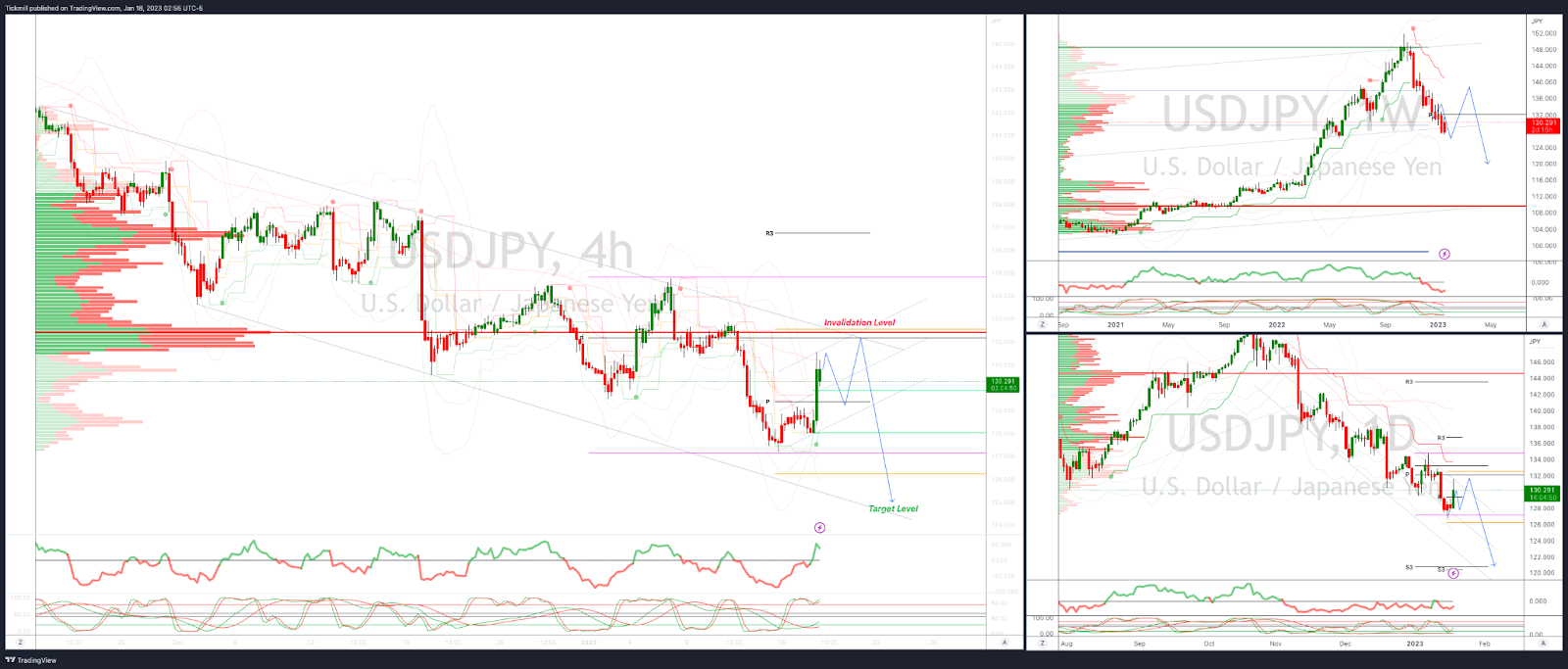

USDJPY Bias: Bullish above Bearish Below 132.30

Primary resistance is 132.30

Primary objective is 125.00

Above 133.00 opens 135.00

20 Day VWAP bearish, 5 Day VWAP bearish

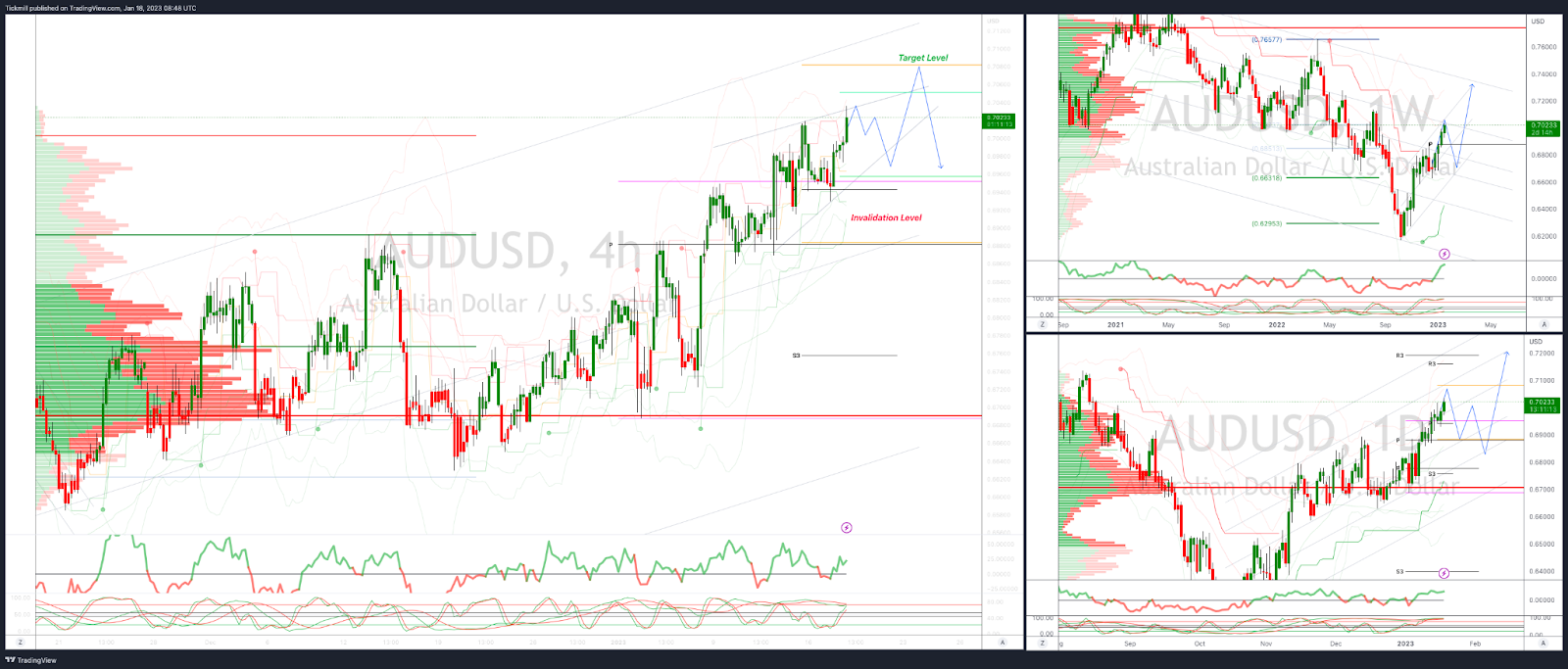

AUDUSD Bias: Bullish Above Bearish below .6920 - .7030 Target Hit, New Pattern Emerging

Primary support is .6920

Primary objective is .7090

Below .6900 opens .6820

20 Day VWAP bullish, 5 Day VWAP bullish

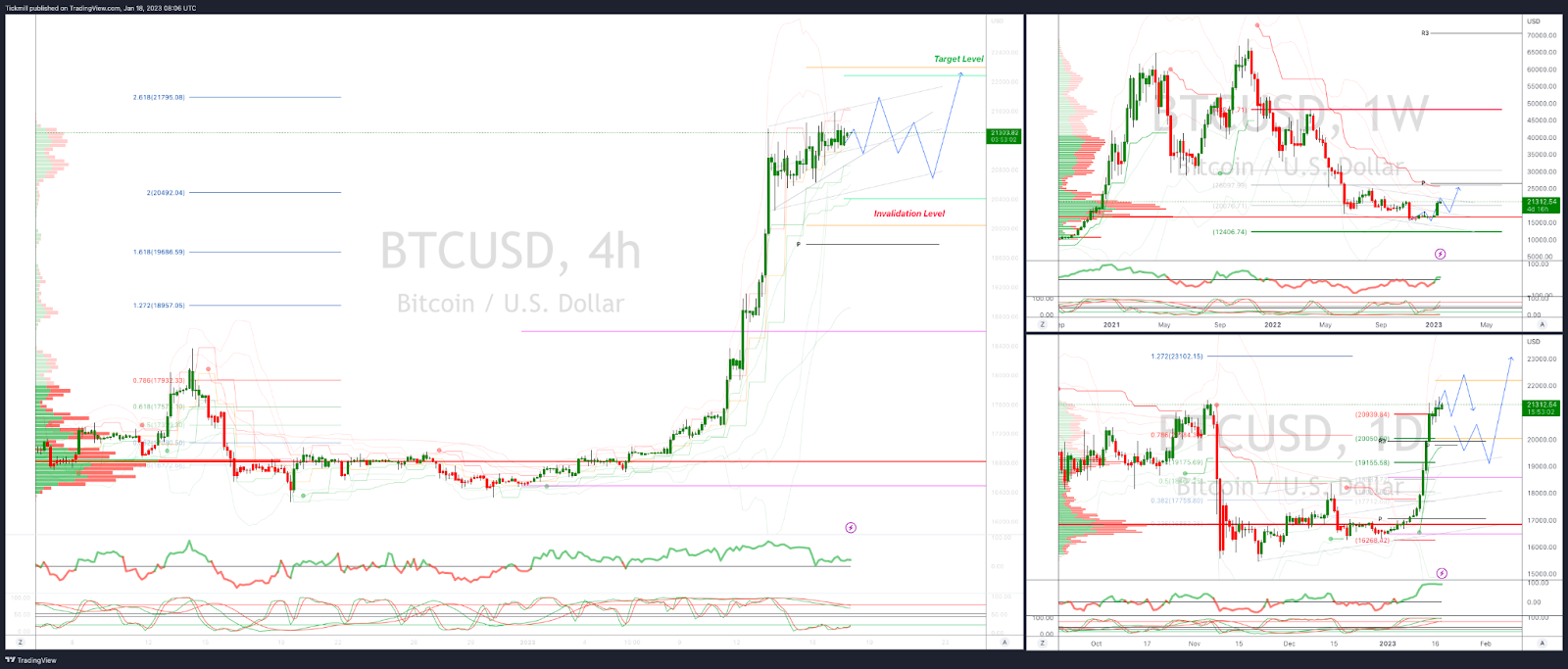

BTCUSD Bias: Bullish Above Bearish below 20200

Primary support 20200

Primary objective is 22400

Below 19900 opens 19300

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!