Crude Traders Monitoring US/Iran & Russia/Ukraine Talks

Crude Lacking Direction for Now

Crude oil prices have seen quieter action this week as the market settles into range while traders digest recent geopolitical developments. There are a number of situations that are currently feeding into oil sentiment.

US/Iran Talks

Among those, the prospect of a new US/Iran nuclear deal, in exchange for a lifting of sanctions on Iranian oil, has been a key factor for crude traders. The prospect of Iranian crude returning to the wider market has clear downside implication for prices. However, talks are reportedly stumbling over US demand around Iran ending its uranium enrichment program. If talks fail, this could lead to a fresh spike in crude prices.

Russia/Ukraine Talks

Traders are also monitoring developments on the Russia/Ukraine front with ongoing peace talks looking poised to deliver a ceasefire. The impact for oil prices should be negative if a ceasefire is agreed with supply risks diminished as well as traders focusing on the prospect of Russian oil returning to market. As with the US/Iran talks, however, crude is vulnerable to a spike higher if talks fail and it looks as though as ceasefire is not forthcoming.

Inventories Data on Watch

Looking ahead this week, traders will be watching the latest API inventories figures today ahead of the headline EIA data tomorrow. Any sign of a further inventories surplus on the back of last week’s data should keep crude price anchored lower through the back of the week.

Technical Views

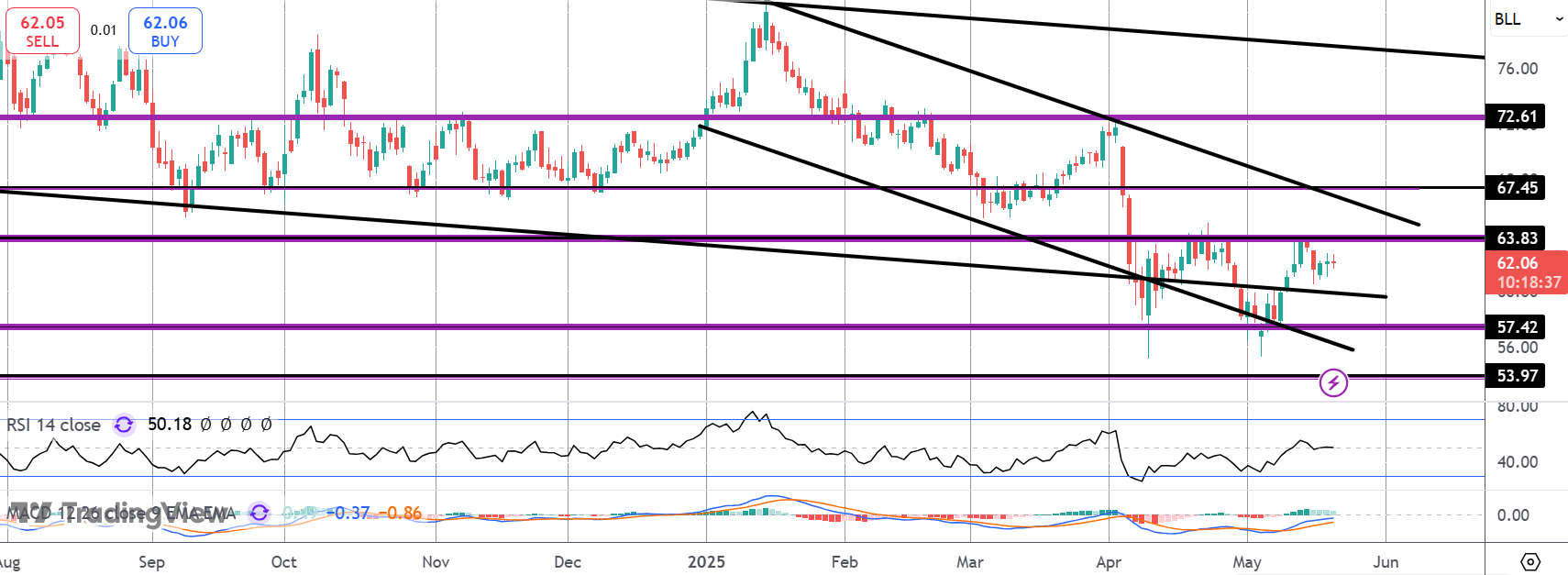

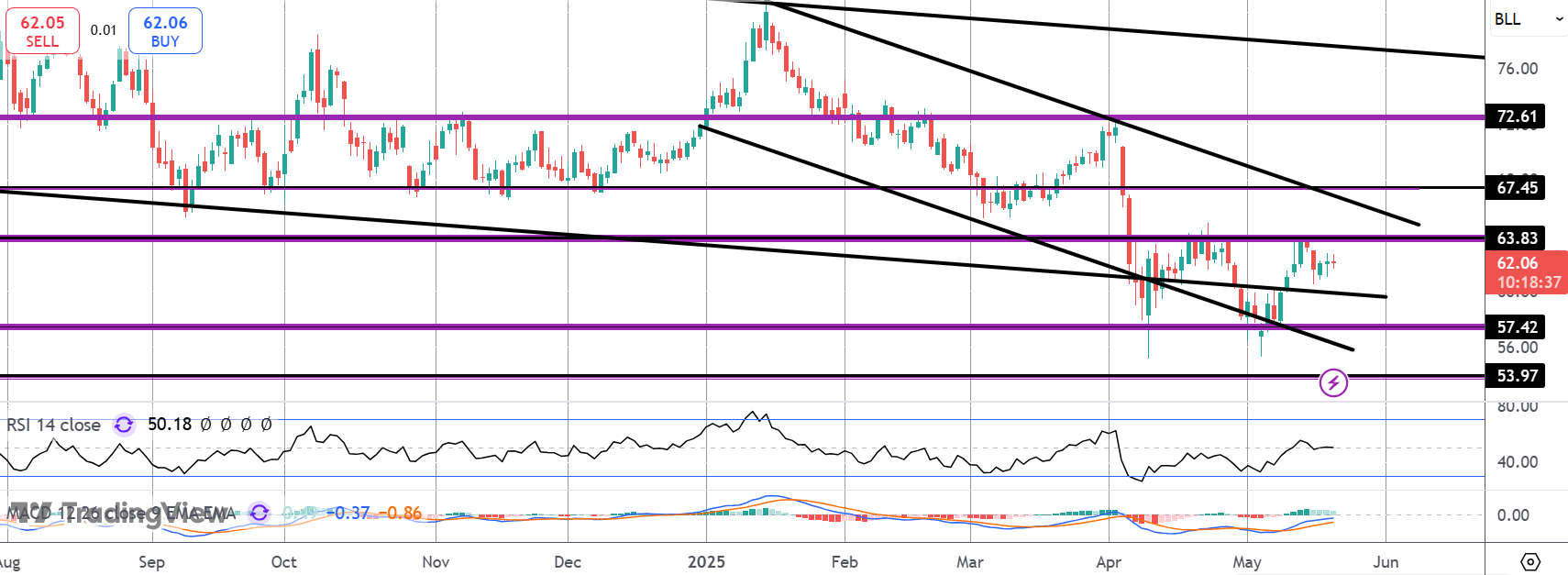

Crude

For now, crude prices remain capped by the 63.83 level resistance. However, the market is potentially carving out an inverse head and shoulders here suggesting room for a fresh push higher with 63.83 the neckline pivot to watch. If we do move above there, the bear channel highs and 67.45 level will be the next resistance to watch. Downside, 57.42 remains key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.