Crude Rallies on EIA Data & Middle East Fears

Fresh EIA Draw Boost Oil

Crude oil prices spiked higher yesterday after news of a larger-than-forecast inventories drawdown, as recorded by the EIA. Falling by a further 3.7 million barrels, US crude stores are now down at their lowest levels since February. The data is an encouraging sign for US demand levels and evidence of a healthy US summer travel season. This is good news for the market given the current broader concerns around potential US recession risks. With demand for physical barrels still robust, wider economic concerns are being offset for now. Additionally, a weaker US Dollar is good news for crude demand meaning the oil prices should be able to maintain a floor for now unless those economic concerns ratchet higher.

Middle East in Focus

Away from the US, the ongoing uncertainty around developments in the Middle East remains a key driver. Fears of a wider conflict emerging remain a key upside threat for oil prices. Markets are currently bracing for a possible Iranian retaliation following the killing of a Hezbollah leader. If seen, the potential for an escalation in violence between Iran and Israel poses a heavy supply risk to oil producers in the region and could see crude prices moving firmly higher near-term. With that in mind, incoming headlines will be closely watched and oil prices are likely to be highly sensitive to any fresh developments.

Technical Views

Crude

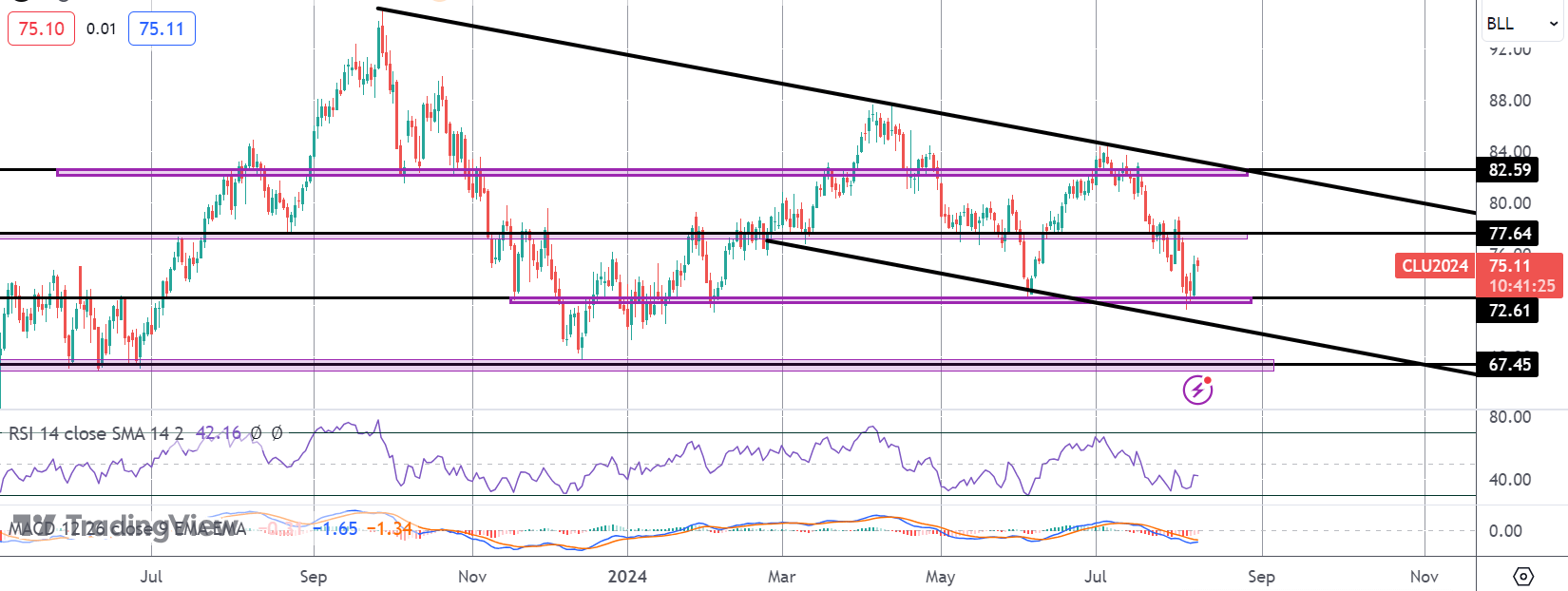

The sell off in crude has stalled for now into a test of the 72.61 level with price now bouncing nicely higher. Momentum studies are starting to turn higher too, putting focus on a further recovery. 77.64 will be the big test for bulls, with a break above needed to put a fresh test of the channel highs in sight.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.