Supply Issues Help Copper

Copper prices are trading at six-week highs today with the futures market continuing to reverse higher off the August lows. The recent uptick looks to be largely driven by fresh supply concerns linked to a drop in activity in China and various supply disruptions in the copper supply chain. China, the largest global consumer of copper, recorded a drop in production levels last month, cutting around 500k tonnes of copper from the market. This comes at a time when LME inventories remain severely depleted after the pre-tariff run up in buying we saw ahead of August. Currently, LME stockpiles are around 40% below seasonal average levels.

Mine Closures

This week, Freeport McMoRan noted that its Indonesian Grasberg mine will stay close this week as a search continues for missing workers. On the back of the recent closures and disruption we’ve seen at Chilean sites in recent months, the disruption is adding to bullish price pressures here.

Dovish Fed View

Finally, the dovish shift in Fed expectations looks to be helping copper also. On the back of recent weakness in labour market data and dovish signalling from the Fed, the market is now widely expecting a cut next week with at least one further cut ahead of year end. This shift should lead to as lower USD in coming weeks, helping created further support for copper prices.

Technical Views

Copper

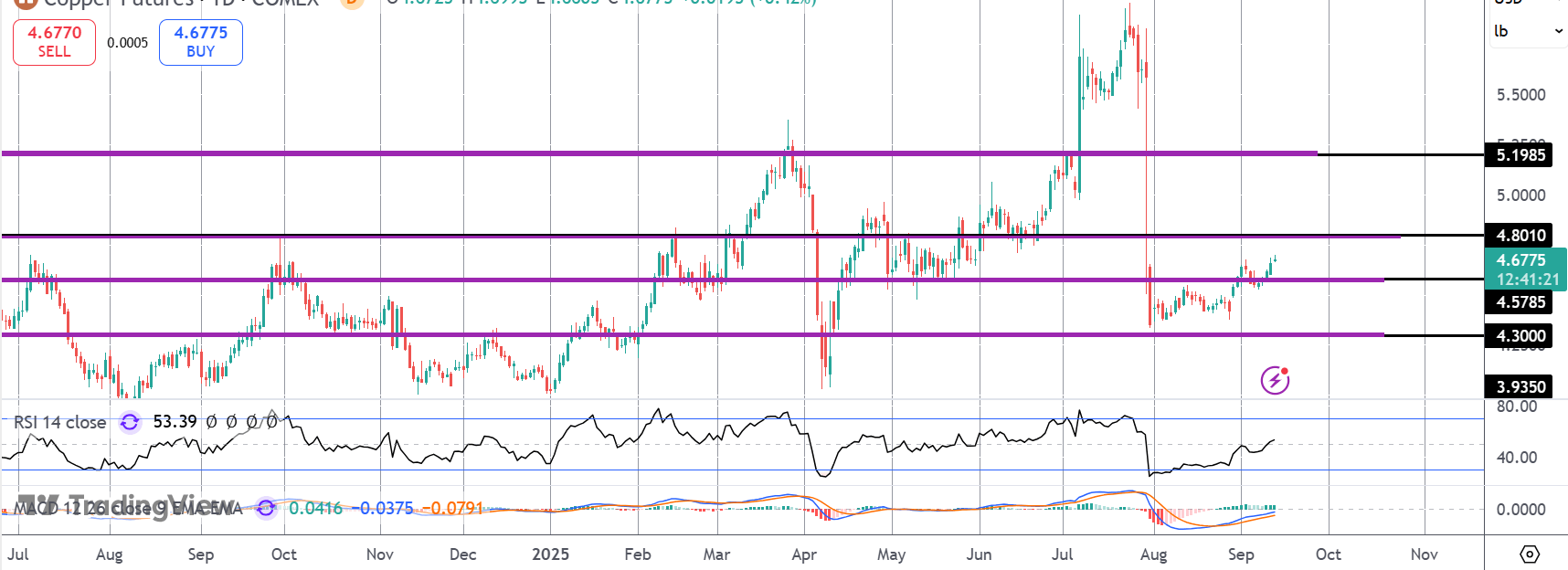

The rally in copper has seen the market breaking back above the 4.5785 level with price now pushing back up towards the 4.8010 level. With momentum studies bullish, focus is on a break higher with 5.1985 the higher target to note. Downside, 4.30 remains the key support to watch near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.