Alphabet Rallying Despite Fed Rates Pushback

Tech Rally Continues

Alphabet Shares in Google’s parent company Alphabet are trading higher ahead of the open on Friday. US stocks have been broadly firmer on the back of better-than-forecast labour market and consumer spending data this week. A continued fall in unemployment claims, following a strong December NFP is bolstering hopes that the US economy can avoid a hard landing, supporting stocks near-term.

Fed in Focus

Indeed, the rally in Alphabet shares comes as part of a broader tech-driven rally in US stocks. It seems that traders are looking past the Fed’s current pushback against expected rate-cuts and are instead focusing on the simple likelihood of looser monetary policy through the year. Fed’s Waller commented this week that the Fed has ample time to ease out of restrictive territory on rates this year and is in no rush. However, the market looks to be taking a simpler view which is: rates are coming down this year.

New UK Data Centre & Q4 Earnings

Alphabet shares are also rising this week on news that the group will push ahead with plans to build a new $1 billion data centre in the UK. With an increased focus on AI, the company is clearly keen to push ahead and take a more aggressive approach in 2024 which is being cheered by investors. Looking ahead, traders are waiting on Alphabet’s Q4 earnings due Jan 30th with the market expecting EPS of $1.595 on revenues of $85.21 billion.

Technical Views

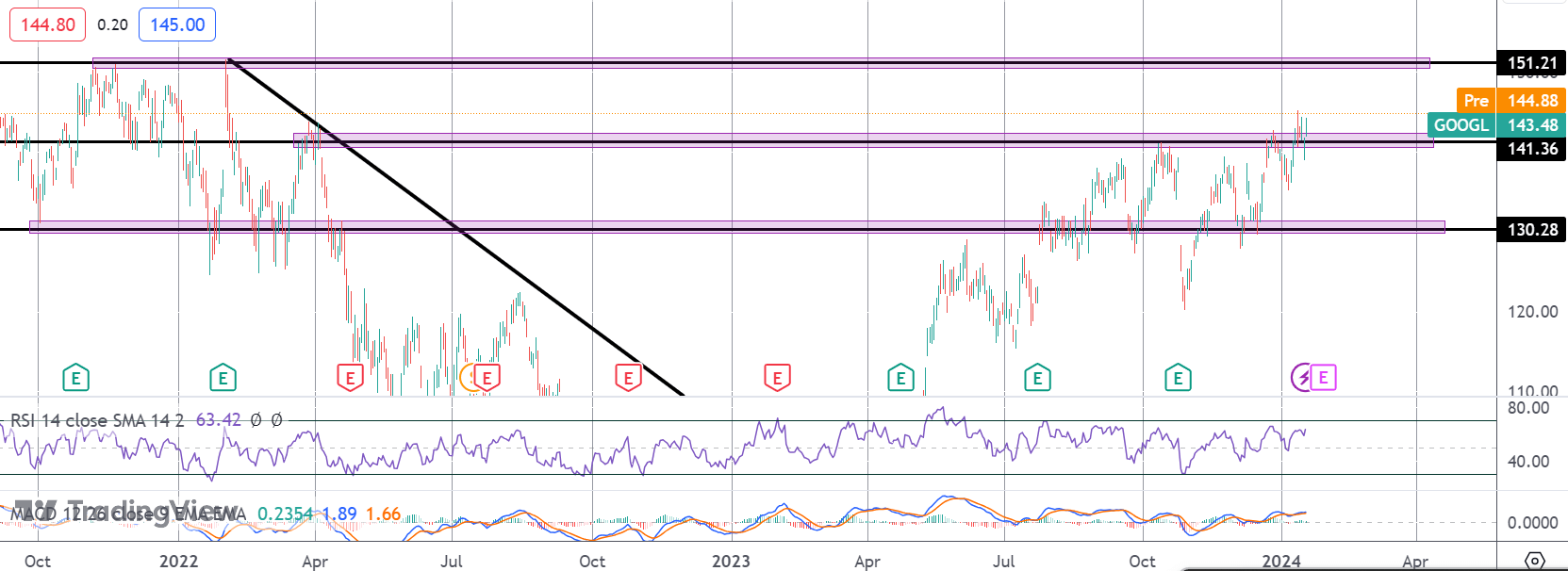

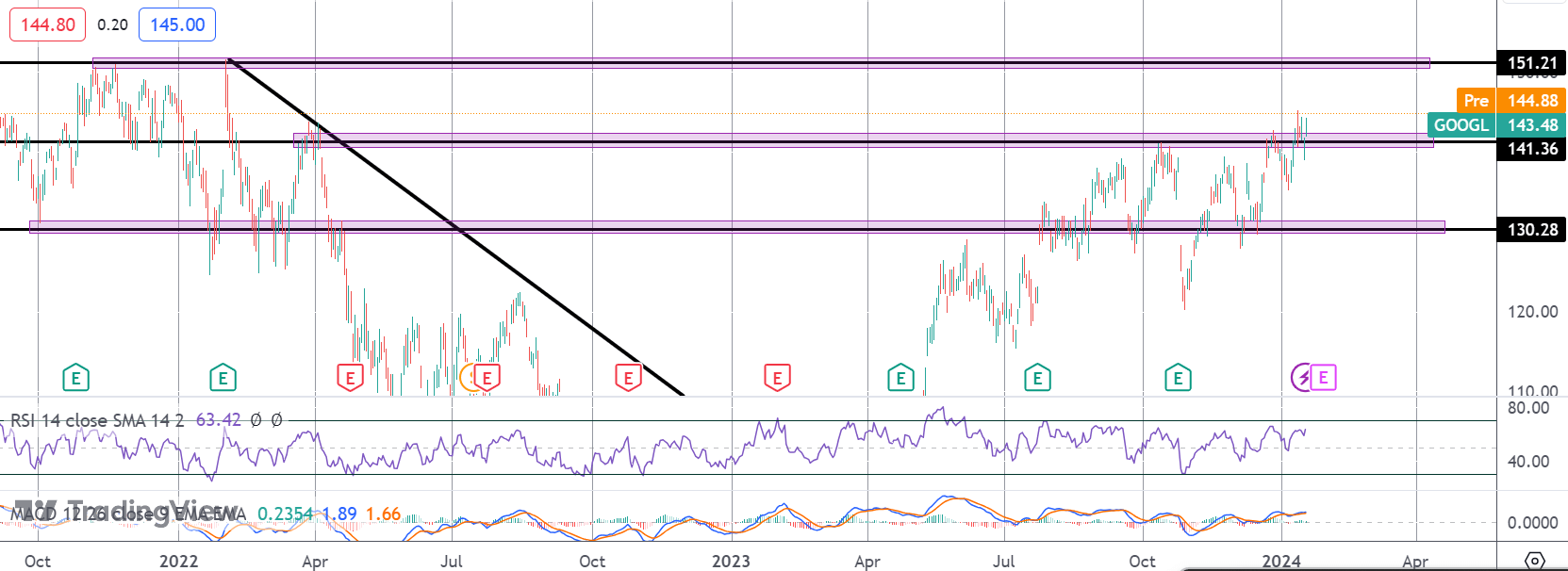

Alphabet

The rally in Alphabet shares has seen the market breaking back above the 141.36 level. While above here, and with momentum studies bullish, the focus is on a further push higher with 151.21 the next resistance level to note. To the downside, any move back below 141.36 will put 130.28 in focus as next key support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.